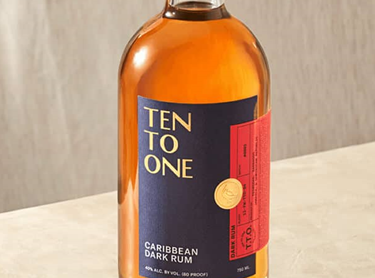

Rum can follow the recent growth seen in Tequila and Bourbon, InvestBev has suggested, after the private-equity investor backed Caribbean brand Ten To One.

InvestBev, which has a portfolio of investments including Siempre Tequila and e-commerce platform Speakeasy Co., has put $1m into Ten To One.

“We invested in Ten To One because we feel that rum has the opportunity to ‘pop’ the same way vodka did in the 90s and Tequila and Bourbon are doing now,” InvestBev founder Brian Rosen told Just Drinks. “You have an aspirational category with age statements and, for those reasons, we feel only the surface has been scratched by the current rum offerings.”

The rum brand, set up in 2019, attracted investment from singer-songwriter Ciara in 2021. Founder Marc Farrell wants to use InvestBev’s funding to open new markets.

“We’ve always sought to identify great investors who not only have resonance with our aspirations for Ten To One but also have the ability to directly impact those ambitions to build something iconic with the brand,” Farrell said.

Rosen described Ten To One as an “ultra-premium” rum. “InvestBev defines ‘ultra-premium’ as $35 or greater for a 750ml bottle where the consumer is clamouring with the ‘look what I found!’ discovery moment,” he explained.

“The consumer, in general, is looking for premiumisation and brands they identify with – that are made, crafted and have a history and a lineage. Ten To One represents all of that.”

Rosen, a former CEO of retailer Sam’s Wines & Spirits and a former president of sales agency BevStrat, founded InvestBev in 2015.

“We invest between $1-10m per business and our equity position is generated by the value of the business,” Rosen said.

The private-equity firm’s portfolio also includes more than 100,000 barrels of raw Bourbon distillate.