Last week American media personality Logan Paul found himself defending his drinks brand Prime against claims it contained so-called “forever chemicals”.

It’s not the first controversy the brand has faced in its short life. There have been complaints about caffeine levels in its energy-drink range, Denmark banned shops from selling it over health concerns last year and shopkeepers have faced security issues as people try and steal the coveted drinks.

Could the latest drama – a consumer class action lawsuit in California claiming the drinks contain harmful per-and poly-fluoroalkyl substances (PFAS) (a claim its founders fiercely refute) – mark the end for the celebrity-made brand?

The sports hydration and energy drinks are still selling for above-average prices compared to peers – though nowhere near their peak, where one off-licence claimed on TikTok it was selling 12-packs for £1,200 ($1,507).

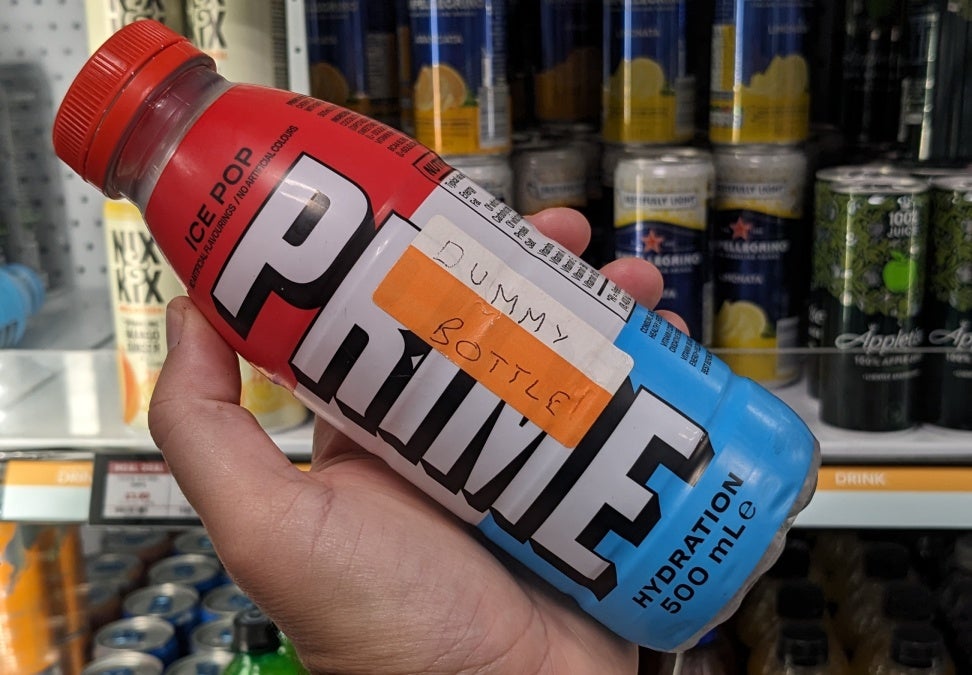

Teacher friends tell me the kids at school still think Prime is cool and this week I spotted bottles being kept behind a shop counter alongside alcohol. Tom Khan-Lavin, founder of UK-based drinks marketing agency YesMore, tells me his local Co-Op supermarket had so many shoplifting problems it only displays dummy bottles.

But the brand has certainly not maintained the “buzz” it entered onto the market with.

Is Prime likely to fade and die?

“Nothing is certain, but I would say the likelihood is Prime will gradually fade and die. It’s all too surface-layer,” says marketing consultant Joe Fattorini.

Prime’s sport drink, ‘hydration’, was launched by Paul and YouTube rapper boxer KSI in 2022 and burst onto the UK market later that year – quickly followed by a caffeinated range, Prime Energy.

Last year it claimed it was set to surpass $1.2bn in annual sales in 2023 and Paul said it was “the fastest growing beverage in history”.

But Fattorini says Prime is at risk of sliding into the category of obsolete celebrity brands – particularly if the popularity of its founders were to waver.

“Prime achieved awareness and recognition. But while a brand at this level is known by shoppers, it lacks deep emotional connections. For celebrity brands, this is often where their influence starts and, in many cases, stays,” he says.

He argues “great” brands need to create an emotional connection with shoppers through values or lifestyle, that goes beyond people just having heard of them.

“There’s an internal connection where shoppers see the brand (and by extension, the celebrity) as a mirror of their own aspirations or values,” he explains. “But what aspirations and values do Logan Paul and KSI really represent?”

As well as emotional connection, he says brands then need a ‘value layer’ to “integrate deeply with cultural or ethical dimensions important to their consumer base”. This is more connected to a society or group than individual aspirations. “Like Linda McCartney vegan meals,” Fattorini explains.

“This value layer is what celebrities are looking for when they talk about the importance of sustainability in their brands. If your product is suspected of being tainted (like Prime) you’re stuffed.”

Finally, a successful brand needs to find cross-generational success. Fattorini cites Coke and IrnBru as examples of successful legacy brands.

“These brands have transcended their origins and become symbols of certain enduring ideals or qualities,” he says. “It’s less about copying and more about embodying principles that have a generational pull.”

Could its youthful audience rescue Prime?

Khan-Lavin, however, is more optimistic about Prime’s potential.

“I’ve always been fascinated by Prime and the fanatical nature of its consumers,” he says. “People, particularly younger people, have become obsessed with it.”

For Khan-Lavin, the celebrity endorsements – which have stretched beyond KSI and Paul to encompass football, baseball and hockey players and musicians and sponsorship deals of soccer teams Bayern Munich, FC Barcelona and Arsenal and the Ultimate Fighting Championship (UFC) – have buoyed the brand.

A survey last year by research and analysis company GlobalData showed 41% of consumers view endorsements by celebrities or organisations as “essential” or “nice to have” when deciding upon product purchases.

Khan-Lavin says a cultural “obsession with fame, celebrity and influencers” has driven people towards Prime – particularly younger people.

“Fame has become a precursor to popularity, and popularity is a currency. So kids (and let’s face it, Prime consumers are predominantly children) at a pivotal moment in their development will naturally align with brands that help provide them with an identity – whether that’s the trainers they wear, the car the parents drop them off at school in or the energy drinks they consume,” he says.

Though slightly alarming, he feels this “predominant base of young impressionable consumers will likely brush off the health risks (just as their parents and grandparents did with cigarettes or alcohol) and favour the popularity of being seen with such a product”.

Prime’s success teeters with public’s interest in founders

Though Fattorini is certainly not against celebrity brands – as he told Just Drinks earlier this year – he says brands like Prime are “driven by the visibility and immediate appeal of the celebrity” rather than strong branding and are thus “vulnerable to rapid obsolescence”.

“Celebrity brands need to navigate deeper into emotional, cultural, and ultimately generational layers, to live a long time,” he says. “It means a shift from leveraging fame to embodying values and ideals that resonate on a broader, more meaningful scale.”

Khan-Lavin counters: “One could argue that the fanatical obsession with Prime could go – which is true – but my suspicion is that with Paul Logan and KSI being street smart, savvy and still very much in their prime, they’ll continue to navigate this brand through almost any challenge this brand is faced with.”

Perhaps the outcome of the US trial will bring more clarity on Prime’s future. If the drinks are found to contain PFASs the brand could, in Joe’s words, be “stuffed”. The question is: will Prime’s largely-sub-20-year-old audience care – and will their purchasing power be enough to sustain it? Either way, the next few years are unlikely to be easy sailing.