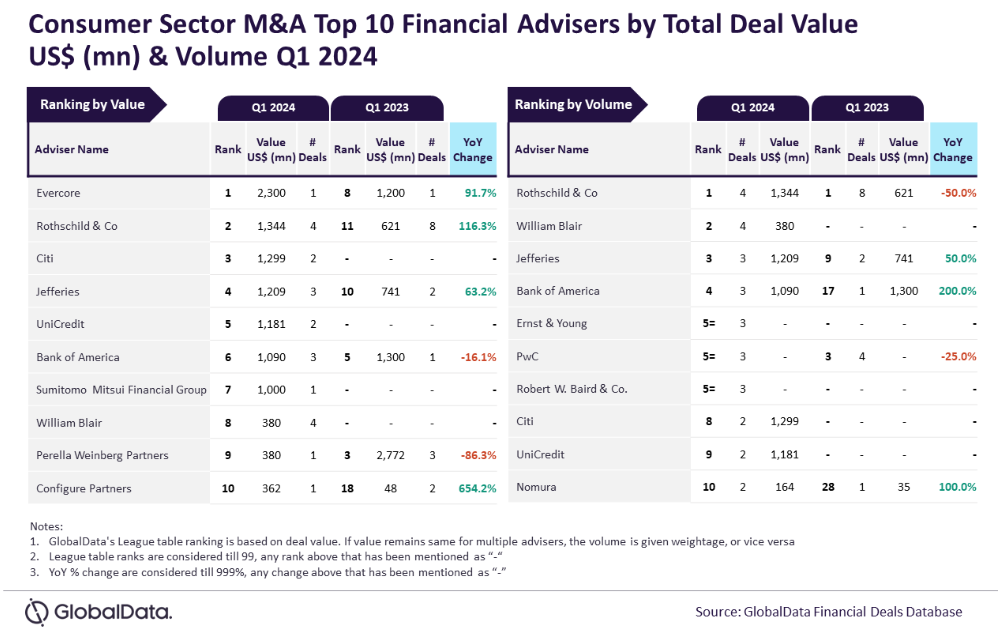

Evercore and Rothschild & Co. were the top M&A financial advisers in the consumer sector in the first quarter of the year, analysis of deal data suggests.

According to the deals database of GlobalData, Just Drinks’ parent, Evercore headed the charts when measuring the value of deals, while Rothschild advised on the most transactions.

Aurojyoti Bose, lead analyst at GlobalData, said: “Evercore registered almost a two-fold jump in the total value of its deals in Q1 2024 compared to Q1 2023. As a result, its ranking leapt from eighth position to top. Rothschild & Co was the top adviser by volume in Q1 2023 and managed to retain its leadership position by this metric in Q1 2024 as well.”

When looking at the value of consumer M&A, Rothschild occupied second position, advising on $1.3bn worth of transactions. Citi, Jefferies and UniCredit rounded out the top five.

Looking at the number of deals, William Blair was second, followed by Jefferies and Bank of America.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.