Kirkland & Ellis was the top M&A legal adviser in the consumer sector during the first half of 2024 by both value and volume, analysis of deal data suggests.

According to GlobalData, Just Food’s parent, Kirkland & Ellis topped the charts for the value of deals and volume of transactions.

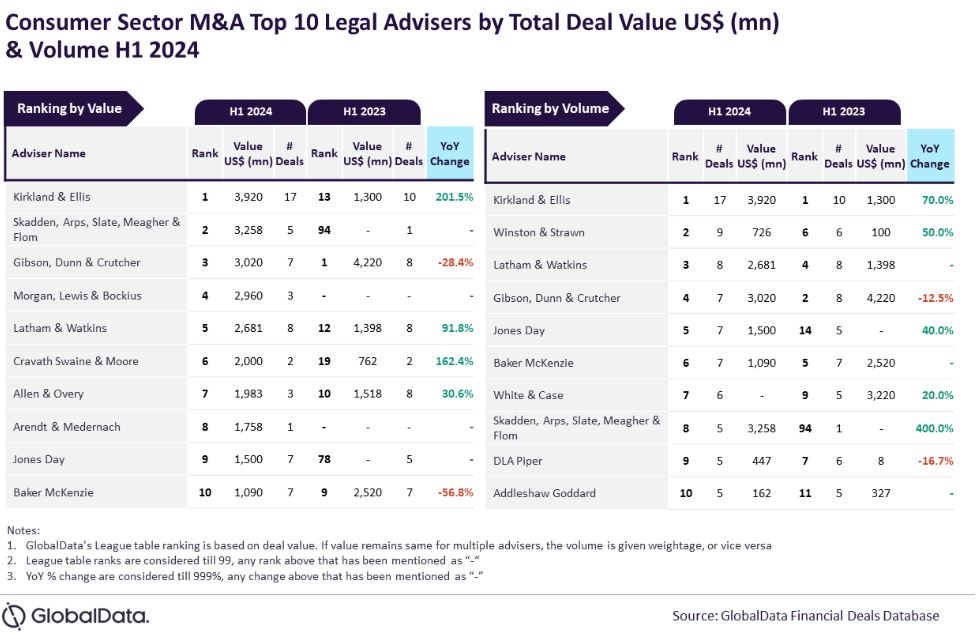

An analysis of the data and analytics group’s Deals Database reveals that Kirkland & Ellis advised on 17 deals worth $3.9bn.

Aurojyoti Bose, lead analyst at GlobalData, said: “Kirkland & Ellis was the only adviser to hit the double-digit deal volume during H1 2024. Interestingly, even during H1 2023, not only was Kirkland & Ellis the top adviser by volume, but it was also the only adviser with double-digit deal volume.

“Moreover, it showcased major improvement in terms of value as well as its ranking in H1 2024 compared to H1 2023. Kirkland & Ellis, which was at the 13th position by value in H1 2023, went ahead to lead the chart in H1 2024.”

Skadden, Arps, Slate, Meagher & Flom occupied the second position in terms of value, advising on $3.3bn of deals, followed by two firms on $3bn – Gibson, Dunn & Crutcher, as well as Morgan, Lewis & Bockius. Latham & Watkins advised on deals worth $2.7bn.

Meanwhile, Winston & Strawn occupied the second position in terms of volume with nine deals, followed by Latham & Watkins with eight tramsactions. Gibson, Dunn & Crutcher and Jones Day both worked on seven deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.