Set up in 2020 in Namyangju, South Korea, Three Societies Distillery has been slowly building its name as the first single malt whisky producer in the country.

Founder and CEO Bryan Do is no stranger to setting up a drinks company, having founded the South Korean craft brewery Hand and Malt Brewing Company in 2014. The group was snapped up in a merger deal by AB InBev in 2018 and is managed today by its South Korean arm Oriental Brewery.

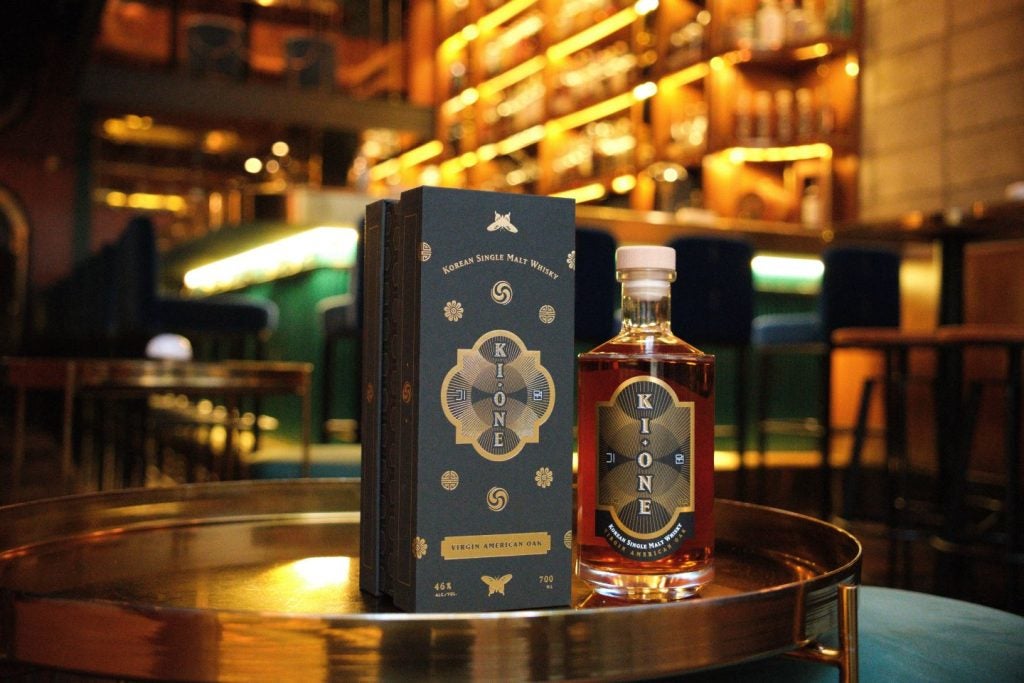

Backed by the local investment firm Saehan Venture Capital since its launch, Three Socities has grown its presence domestically and internationally, with its Ki One single malt whiskies now available in seven international markets. This includes the US, and most recently the UK through a deal with the Pernod Ricard-owned retailer The Whisky Exchange.

In a market saturated by big players, the distiller looks to play on the growing global consumer interest in Korea to drive future success. Just Drinks sat down with CEO and founder Bryan Do to discuss the group’s growth plans at a time when consumer spending is tight and the local regulations hampering South Korean craft whisk(e)y production.

Fiona Holland (FH): How do you view the global whisk(e)y category at the moment and why do you see opportunity for South Korean whisk(e)y?

Bryan Do (BD): Aside from the stalwarts, mainly Scotch whisky, Bourbon whiskey and, of course from Asia, Japanese whiskey … I think there’s such a huge growth going on right now in world whiskies that it’s actually a pretty good time to be coming in, aside from the fact that the market itself is a little bit depressed right now. Korea’s market is fairly down too… I think luxury items such as single malt [are] feeling a little less of a pinch, but still, there’s a pinch everywhere.

In other terms, I think just because Korea is kind of… the flavour of the month lately in terms of kind of soft power around the world, that gives us a better footing and more interest for Korean products… There’s such an influx of tourists in the past year into Korea, and there’s so much more interest in everything Korean, starting from K-pop to K-drama, to movies, to fashion and to beauty.

Our local sales are down overall for Korea. However, the thing that’s bolstering our bottom line right now in a very good way is our duty-free sales. And I think our domestic sales would be even worse if there wasn’t so many foreign tourists coming in and going, “Wow, there’s a Korean whisk(e)y. Let me try that”… we’re not even over with the year yet and we’re already about 82% more than we sold last year.

FH: Where are your most important markets?

BD: Our biggest market, of course, is Korea. We’re in Korea domestically and duty free… We’re also in seven different markets around the world, not in their duty free yet, except for Taiwan. So the seven countries that we’re in is United States, of course recently, the UK, Japan, Taiwan… Singapore, Hong Kong and Kazakhstan.

We’re just riding upon this Korean wave that’s going on, and that was totally random, but the Stans… love everything Korean right now.

FH: What is your strategy for entering new markets?

BD: Our strategy mostly is to hit the whisk(e)y enthusiasts and the malt shops and bars first in each country, and especially because there’s such a large diaspora of Koreans outside of Korea. The largest is the US, after that is China, and then Japan following in first, second, third. It’s a little bit easier to hit those places because there’s a lot of Korean kind of nationalism, curiosity. So, it would start off as malt, single malt kind of enthusiasts and whiskey enthusiasts, and then it would go into the Korean establishments, whether it be higher end restaurants or in the US, there’s a lot of bars that are catered around Korean food and drinks.

FH: What was the reason behind your entry into the UK? Why do you think Ki One will do well there?

BD: The UK is a significant market for us. It’s the birthplace of single malt whisky so it’s significant for that in that reason alone, but also our master distiller, blender and partner, Andrew Shand is from Scotland. He was, you know, born on the grounds in Loch Lomond, and grew up in a distilling family. So it makes sense for us to be in the UK and to do well in the UK. We’re not trying to sell massive volumes of Korean whisk(e)y right now, hopefully later on in the future. We’d like to, but right now, we just want to introduce this new style of whisk(e)y.

FH: Your barley is mostly sourced from the UK. Why did you decide not to source it locally?

BD: [Around] 98% of our barley is sourced from the UK, from your usual suspects, Crisp, Bairs, Muntons… The other 2% is locally grown. Of that 2%, 1% is from our barley fields. We are making a single estate, single malt whisky, so it’s a mixture in between. I don’t know how long we’re going to do it because it is a very hard process… so I’m doing that kind of out of my own passion. Financially, it does not make sense at all. Taste wise… there’s a hint of a difference, but not too far off in taste, I would say.

FH: Would you ever look to source your barley fully from South Korea?

BD: We are working with the Korean government to make that happen. I don’t see that happening in the near future. There are some rules and regulations that need to be abolished before that happens in earnest. There’s a maltster down in the south of South Korea, which has probably one of the best malting facilities I’ve seen in a long time. Everything’s very up to date and technologically advanced, it’s just that they don’t get enough barley and practice to make a very efficient malt.

FH: What specific regulations would need to change?

BD: Well, that malting house was set up for that specific region, and they don’t like to take other regions barley and malt. It’s not illegal to do it, it’s just very much frowned upon because they only want to malt that region’s barley that they have. We kind of have to get on our knees to make them do it for us… I think legally, there’s ways around it, but they just throw that just to make it more difficult for us because they know they have pretty much the only malting facility in Korea.

FH: How do you expect sales volumes to pan out this year and next year and how do you look to grow those?

BD: This year, we’d like to actually be flat. We know the big boys in Korea are down 15-20% right now…in Korea, they’re down that much [or] that’s kind of what they’re forecasting. That’s probably in line with a lot of places globally, too. We’d like to be flat, I think we’re on our way to being flat. I think that would be a that’d be a win for us right now. Next year, we’d like to grow about 10% if we can.

FH: Do you expect you’ll need to adapt your pricing strategy as consumers are currently tighter with their spending?

BD: In Korea, we’re in the ultra-premium category right now, I think we want to remain in the ultra-premium category, just as a brand [as] a whole… We want to sit with the likes of a Macallan 12 or a Glenfiddich 12, something in that range… but we are going to release three signature items at the end of this year. With that, we are going to reduce the cost to kind of in the level right now we’d like to be in under, coming under Won100,000 ($73.27 per bottle) approximately, that’s just a psychological barrier that’s there. We’re not sure if we can get to that right now.

We’re working on a rebranding of our bottle and our packaging for that reason… in Korea the regulations [mean] we get taxed on our packaging. The better packaging you make, the more expensive your whisk(e)y is… we have a specific sales tax. Currently, we’re one of the only three countries in the OECD that is still using this tax, and that’s because whisk(e)y just hasn’t been made in Korea [prior to] the 80s, but nobody’s remembered that. Because of that, the regulations have to catch up, and the government is already looking into bringing down those taxes, or to getting into an ad valorem tax where it would be much more beneficial for whiskey producers… We think it’ll come probably in two years, when most of the other distilleries come online, but I just see it as [in a] matter of time that it will change.

FH: What’s the breakdown of shareholding in Three Societies?

BD: I am not the majority shareholder. I am next in line. I’m very close to the majority though, but there is a venture capital that started it off in Seoul. The venture capital’s name is Saehan. They’re not majority, but they have the largest share. And then it’s me, followed very closely. The third largest shareholder is Andrew [followed by friends and family].

FH: What are the business’s biggest opportunities for growth over the next couple of years?

BD: I think because we’re such a new category in Korea, the growth is going to be big in Korea.

People are starting to get to know about us, more Koreans are more interested. I see that growth in Korea first, and then the second growth also will be for outside of Korea. Just as I said before, the diaspora of Koreans and the curiosity, because it’s a Korean product that many people outside of Korea would have for a Korean single malt whisky.

FH: You also produce a gin. How has this performed and do you expect to focus more on gin down the line?

BD: We have a single malt gin which is very unique because we use the same base spirit as our whisky for the gin, a very premium gin. It’s a sipping gin of course. We didn’t want to compete with the thousands of other gins out there, so we wanted to make a single malt gin with some Korean botanicals… It’s a very slow growing category in Korea, but people are starting to warm up to the white spirits. There’s now three other gin makers too, but we’re the only ones using our own spirits.

[The product is] in most of the other markets. We didn’t send it to the UK this time, just because that’s such a saturated market and it’s so hard to break in… that’s such a hard market for us, we’d rather focus on what our bread and butter is.FH: Are you considering growing your portfolio in the future?

BD: We just launched what’s becoming popular in Asia, a whisk(e)y highball. In Asia, [the] canned liquid whisk(e)y highballs are popular right now, but we made a large format in a champagne bottle, and we just sold out just last week… So now because of that, we’re going to have to kind of rejig our production line, where we have to put in a bottling facility, to start that up. I don’t know if we’ll do it in earnest this year, probably next year, we’ll start that up. It’s a large format RTD, very high end.

FH: Do you think there would be a demand for that outside of Korea?

BD: We’re focusing on Korea first. I don’t know if there will be outside of Asia for sure. I know Asia, yes, just because it’s so popular. Taiwan and Japan, I think it’ll work in those markets too.

FH: Why did you decide to try that product out?

BD: We wanted to just see what more innovation we can do, and what different form factors would excite the market that there hasn’t been a bottled highball in Korea yet. We’re the first ones to put it in a glass bottle, too and we’re just trying to see would they be receptive to this? And a lot of the high-end restaurants in Korea are very receptive to it. We’ve sold out very quickly, much faster than I had imagined.

There’s a lot of things that we’re doing now that we can’t do in Scotland or in the UK… we’re using craft beer malts… I know a lot of people around the world are doing that also, but with my craft beer background I kind of know which malt is going to taste like what… We’re trying different woods in Korea. We’ll be coming out in October, with a all-Korea edition [single malt], which means Korean malt, Korean water, Korean yeast, and Korean oak, much like the mizunara, Japanese oak… we’re trying to push the boundaries on there, trying to see if we can use other types of Korean wood too next year.

We’re [also] working with different traditional Korean liquor makers. There are two types of other popular traditional liquors. The first one is called bokbunja, which is like a Korean sherry. It’s a sweet raspberry wine that’s very popular. We work with one of the largest producers, we have a barrel exchange with them. They’ve aged their bokbunja in barrels… So we have a Korean Sherry that will be coming out soon… and the other one is a very popular drink in Japan and Korea. It’s umeshu, which is a sweet plum wine [from] small green sweet plums. The company in Korea that makes a lot of it, even for Japan, we do a barrel exchange program with them [Bohae]. They age their own umeshu in our barrels… we’re constantly looking out, trying to make it a little bit more Korean for the local market and for the export market.

FH: Will you expand into other areas within whisk(e)y?

BD: We first want to start off with a single malt, because we want to kind of make sure that everybody knows that we’re a premium brand and then we will most likely go into blended whiskeys in the future, so they can go into many different venues. Not just on-trade and off-trade but different venues that are popular in Korea that won’t be able to take a single malt. With a blended, bartenders will be able to pick those up a lot more easily to make into different cocktails… We definitely will do a blended in the future, maybe probably two, three years down the line.