A multitude of factors are at play when it comes to fostering growth in non-alcoholic spirits – from price and availability, both on- and off-premise, to branding and the increasing consumer interest in health and wellness.

Nevertheless, taste is a key consideration in order to drive growth in the category, and to convince consumers to come back for more after the initial trial.

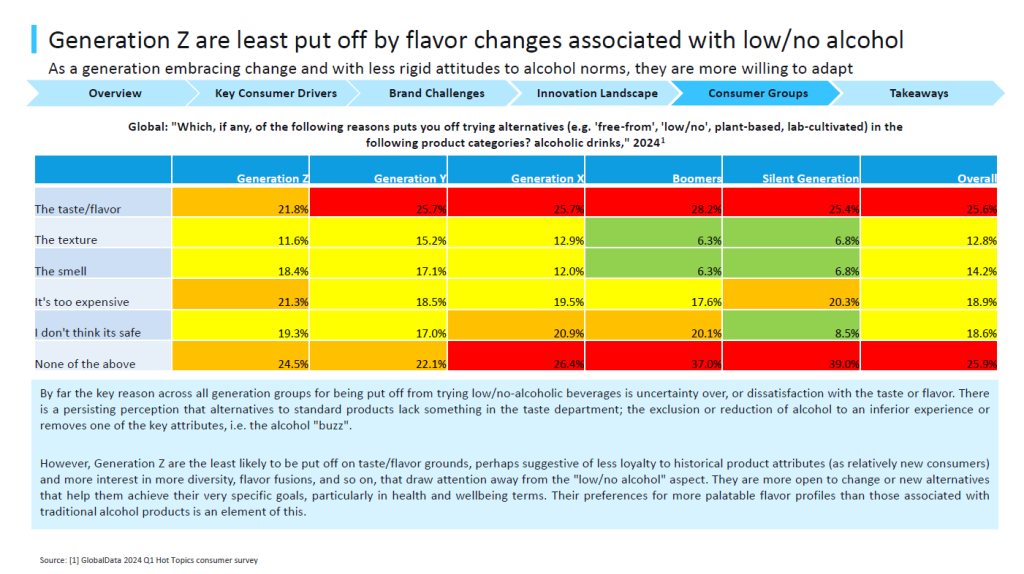

In a consumer survey conducted last year by Just Drinks’ parent company GlobalData, taste and flavour were the key reasons for being discouraged to try “alternatives” in alcoholic drinks, across all age groups, with the Boomer generation most likely to be “put off”, while Gen Z were least likely.

Despite ongoing consumer hesitancy around taste in low- and zero-alcohol variants, some producers argue that non-alcoholic spirits now have access to the necessary technology and ingredients needed to develop winning flavour.

“This sort of landscape of the supply chain – whether that’s people making their own products or relying on third parties – all the technology exists now to be able to extract great flavour from great ingredients,” says Ben Branson, co-founder of distilled non-alcoholic spirit brand Seedlip, now owned by Diageo. “That supply chain is very global, so I guess there’s no excuse for not having great-tasting liquids.”

Branson presently heads up Pollen Projects, which claims to be “the world’s first venture studio” for the alcohol-free category. The venture has two “projects” in the works – Seasn, a bitters range, and Sylva, a dark-aged spirit made through grain distillation and maturated with different types of wood, including padauk, red oak, and wood from Buffalo Trace whiskey casks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“When you think [of] the reason why people keep drinking our drinks, it’s because they taste nice”, he says. “We’re not drinking them for hydration. We’re not drinking them, in the majority, for an effect or for a kind of functional reason. It sounds really obvious, but they’ve got to taste great because that’s why people will choose them again.”

Non-alcoholic spirits are comprised of an array of brand extensions, category replicas, plus non-mimic brands that are looking to develop completely novel types of spirits with unique flavour profiles, but is there a secret to nailing the flavour profile in a young and developing category?

Mimicry is king

As with non-alcoholic beer and wine, a question hanging over non-alcoholic spirits is whether they taste like ‘the real thing’. Smaller producers see this mimicry of spirits categories as a hurdle to progress.

“I think there’s a lot of imitation that goes on in our category, or a lot of attempted imitation that goes on to try and taste like something else,” Branson says. “I feel like I just keep banging the same drum, which is that we don’t have to do that, and that’s incredibly narrow actually when you think about just how few alcohol categories there are.”

Carl Brown, co-founder of UK-based Crossip, agrees, suggesting “there’s a big onus on copying, and I think that is where the problem comes in”.

Instead of imitating a specific alcoholic spirit, Crossip’s five SKUs focus on different flavour profiles – Blazing Pineapple, Dandy Smoke, Fresh Citrus and Pure Hibiscus.

“I’m not going to copy… a gin, vodka, rum or whatever, because then people are expecting that flavour, and they’re expecting it to be exactly the same, and fundamentally, that’s never going to happen,” Brown says.

When it comes down to non-alcoholic spirit launches, gin alternatives have led the segment so far, according to Kevin Baker, director of alcohol beverages at GlobaData. Mainly, he says, “due to the fact that the distillation of botanicals can be replicated without the creation of alcohol, making it easier to replicate the flavour of the core alcoholic variants”.

Imitation is evident in larger companies through brand extensions. Take Diageo’s zero variations of Tanqueray and Gordon’s gins, Captain Morgan Spiced Gold, Bacardi’s two-SKUs extension for Martini, and Pernod Ricard’s 0.0% version of its Beefeater gin launched in Spain last year.

This isn’t to say spirits giants haven’t branched out beyond of extensions. Pernod Ricard has owned Ceder’s non-alcoholic spirits range since 2021, while Diageo acquired Seedlip in 2019 and scooped up Ritual Zero Proof in September.

Campari Group also has the non-alcoholic aperitivo Crodino and a two-strong alcohol-free bottled spirits range targeting the on-premise sector called Bitter Note and Ruby Tone. Crodino, sold across Europe and soon to roll out in North America, is marketed as a standalone brand.

Andrea Neri, managing director, House of Aperitifs at Campari Group, explains that with Crodino, the business looks to produce a drink with “a rich and complex tasting experience with its own distinctive personality, without mimicking historical alcoholic products”.

He adds: “Crodino is not a reactionary ‘non-alcoholic imitation’: it is a strong, well-established, authentic, and loved product perfect for the aperitivo that transcends and precedes the recent non-alcoholic trend.” The brand has been around since 1965 and acquired by Campari Group in 1995.

Some big-player brands, however, do market drinks as being alternatives to specific spirits. Diageo’s Ritual Zero Proof for example, frames its five-strong SKU range as “alternatives” to Tequila, rum, whiskey, gin and aperitifs, promising in its USP to deliver that same “flavour and aroma”.

Technicalities

Dealcoholisation techniques, such as membrane separation and vacuum distillation, are commonly used in non-alcoholic beer and non-alcoholic wine. However, players in the non-alcoholic spirits space seem to be embracing more novel technologies and unique ingredient combinations.

For Crodino, Campari Group uses a secret mixture of herbs, spices, wood and root extracts, which are infused for six months. Diageo also keeps its cards close to its chest with its recipe for Tanqueray 0.0, but the process involves immersing botanicals in water, adding heat and then distilling.

Siobhan Hamilton, general manager of innovation for Diageo’s European and Africa markets, explains: “This special distillation process is a closely-guarded secret, known only to a handful of people, and we are incredibly proud to be bringing gin drinkers that juniper- and citrus-led taste they’re expecting from Tanqueray when they choose not to drink alcohol.”

Crossip uses maceration to extract flavour. The process involves putting raw ingredients in a blend of water, glycerin, eucalyptus, ginger, cayenne and gentian, and then putting them under high pressure to extract flavours and produce a heavy liquid. The liquids are then blended to develop the final bottled product.

Brown decided not to head down the dealcoholisation path, mainly due to price, but also because he did not see the value in attempting to replicate a particular spirit category.

“There are ways to do it to a close-ish way,” he says. “It depends if you’re going to dealcoholise something – that makes a big difference. I personally didn’t go down that route, and it’s a lot more money… you can get very close to copying, but you won’t be exactly the same.”

Some producers are also looking to completely new forms of technology to develop unique flavours. Branson’s Sylva project uses ultrasound waves to age the liquid. After roasting a combination of wood types, the wood and rye distillate are put into kegs, placed in an ultrasound chamber, and then exposed to a frequency of 28,000 kilohertz per second.

“A tiny little explosion happens between the ultrasound waves and the wood, which ultimately explodes out the flavour and the character and the colour of the wood,” Branson explains.

When asked what types of technologies and processes we might see more of in the category down the line, Branson says processes like vacuum distillation allow producers to use “lighter, more delicate, more leafy” ingredients, while spinning cone technology, already used regularly in non-alcohol beer and wine, were “at scale and pretty well understood”.

Ultrasound on the other hand is less known in the industry, he says, “but it’s a process that we really like and is effective as an extraction technique”.

An important factor to consider, Branson adds, is that most low-and-no spirit brands are “relying on the flavour industry, and bottlers and co-packers”, meaning the whole flavouring process isn’t fully within their grasp.

He adds: “A lot of the extraction technology within our categories is not owned by the brands in our category, it’s a very outsourced industry.” For instance, the Pollen Projects team is in control of production for Sylva, but production of Seasn bitters is outsourced.

“I don’t think there’s a playbook to what is good and what isn’t,” says Imme Ermgassen, co-founder of alcohol-free aperitivo brand Botivo, adding: “We’re going to have to see more and more of those kinds of innovative techniques to get to it, because just using flavours and water and current technologies isn’t working hard enough to get to where we need to get.”

While Botivo is mostly focused on a small batch, single-SKU proposition, it has also experimented with borrowing from classic spirit aging techniques. Earlier this year, the brand partnered with London-based fine wine and spirits retailer Berry Bros & Rudd to launch a limited-edition version of its drink, which had been aged in Islay whisky barrels for three years, giving the typically bittersweet, citrusy, herbal beverage added smoky notes.

What consumers want

Despite the market featuring a mixture of standalone products, brand extensions and category alternatives, it seems that some consumers are still looking for replicas within the spirits category, but this depends on the market.

For Crossip, consumers in the Middle East, its most important market, have been more receptive to its flavour-focused products as opposed to an alternative to a Tequila or whiskey.

Brown explains: “There, people are much more open-minded on how they’re going to use it, how they’re going to develop it, and that’s a really wonderful way to go.”

The Middle East may indeed be a key region for growth for Crossip, but in non-alc spirits’ larger markets like Europe and the US, there still appears to be a demand for non-alcoholic copies of alcoholic spirits. “When we think of the UK, the States…. Europe or these markets, the much bigger challenge on spirits is people are just wanting that exact replica,” Brown says.

Though SMEs are looking to champion crafted and unique flavours in order to frame non-alc spirits as a new category that doesn’t imitate a specific alcoholic spirit, it seems some consumers at least need some sort of baseline to compare these drinks to.

As Pollen Projects’ Branson puts it, developing flavour in non-alcoholic spirits is “a bit of a balancing act of bringing some familiarity to the drinker, but also being able to make use of the freedom of being able to experiment with lots of different ingredients”.

The abv question

While copying specific spirits categories might not be a popular choice for all non-alcoholic producers, trying to replicate that warm sensation we get at the back of our throats when drinking spirits is deemed essential to help the category stand out from other alcohol-free drinks like soft drinks or flavoured waters.

As Botivo’s Ermgassen says: “There’s a few things which define and differentiate non-alcs from soft drinks, and that mouthfeel is a really, really important part of defining that category and ensuring that it feels separate.”

Delivering the experience alcohol gives drinkers without the key ingredient in question is easier said than done.

“Consumers crave the warmth, tingling and bitterness that alcohol delivers – but replacing these sensations is no easy feat,” explains John Kelly, beverages strategy director at ingredients and flavourings house Kerry Group. “The challenge is finding technology that targets the right receptors in the tongue, triggering the same sensory experience, but without the alcohol.”

Kerry provides a range of solutions to help manufacturers give their non-alcoholic drinks the same “great taste”, he says. These include Spirit Absolutes, a technology that claims to offer “the same warmth and punch consumers love”. Kerry’s Tastesense Sensations ingredients portfolio is also said to be able to “[trigger] the impact of heat, cooling and tingling sensations”.

So, is it possible to recreate those sensations alcohol typically gives spirits at 0.0% abv?

Hamilton at Diageo says its Tanqueray “never comes into contact with alcohol” and uses a “careful selection of flavours and ingredients” which “release[s] across the temporal profile”.

Crossip also doesn’t use any alcohol in production, while Botivo sits at 0.2% abv due to the alcohol from one of the drinks’ key ingredients – apple cider vinegar, which Ermgassen says “has a lot of the complexity to it that alcohol does”.

For Brown, going up to 0.5% benefits brands looking to replicate spirits categories, “so if you are making a whiskey, it just gives you a little hint coming through, closer to that. But equally, I don’t personally believe that making exact replicas is the way forward”.

Having that small abv amount does have its benefits, according to Branson at Pollen Projects. “It’s really helpful to be able to have the option to use some ethanol in the process, because it is so effective, and that means we can make a better product at a better price in the right amount of time.”

Talking about Sylva, which has 0.5% abv, he adds that the team has been able to develop a warm sensation “in the throat and in the chest and the back of the neck and into the eyes – I would call that a kind of alcohol impression that we’ve been able to deliver with our liquids”.

He could not confirm whether that tiny level of alcohol on its own is what gives the drink its warmth. That aspect of production stays confidential for now.

Regardless of what’s been achieved so far, when it comes to mouthfeel, Branson stresses there’s still work to do: “Mouthfeel and body is, and will be, a continual opportunity to experiment and test for producers, for flavour houses and extract makers, and the alcohol companies as well.”

All in good time

When it comes to flavour, non-alcoholic spirits players are still figuring out how to deliver unique taste experiences without alcohol, and that won’t happen overnight.

“We basically believe that in order to get the richest, most complex flavours, you have to use real ingredients. You have to use processes that take time,” says Botivo’s Ermgassen. “There are no shortcuts. I think that for me, one of the challenges with a non-alcoholic experience is that I don’t think enough time is always taken to really bring out and draw those flavours out.”

For now, there are consumers who remain enticed by spirit category ‘copies’ and 0.0% versions of big brands as they search for something familiar in a young category, but some producers are hopeful that the market will eventually see a shift to consumers accepting non-alcoholic spirits as an independent non-imitative category that puts unique flavours first.

As Brown says, large brands dominate the market for now, but “as people get more used to it, then you start looking for your vibe… I think when people get to that stage, the growth of flavour, the interest, the depth of what you’re looking for, the knowledge of what you’re looking for as well, will be so much more interesting…it becomes more flavour based.”