President Trump’s threat to impose tariffs on imports from Canada, Mexico and China initially and, potentially, the EU at a later date has left countries and companies wondering how such a move would affect them. We look at the likely implications.

What’s the latest?

President Trump has shown that his pre-inauguration threat to impose hefty trade tariffs on Canada, Mexico and China was not mere sabre-rattling.

But he has also shown that he is open to a deal. Following calls with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau, and their agreement to spend big on tightening up security at their borders with the US, the implementation of 25% tariffs on Canadian and Mexican imports has been paused for a month.

However, a 10% tariff on Chinese imports has been introduced, leading to Beijing reciprocating in kind.

Does a threat remain?

Yes. The Canada and Mexico deals are, at this stage, just postponements and while a trade war with China could yet be averted – as Beijing’s levy on US goods is not due to be introduced until next Monday (10 February) and Trump is due to hold talks with his Chinese counterpart Xi Jinping – tension between the world’s two largest economies remains.

China has responded to the start of US tariffs by introducing measures of its own, of either 10% or 15%, on a range of US imports including agricultural machinery, coal and natural gas.

Trump also told the UK broadcaster the BBC that the US will “definitely” impose trade tariffs on the European Union.

What’s President Trump’s aim?

Trump is undoubtedly a protectionist. His ‘America First’ approach is intended to protect manufacturing jobs at home by pressurising manufacturers selling to Americans to be based there.

He also believes the US is being ripped off by trading partners. Speaking about the EU this weekend, he said the trade deficit the US has with the bloc is “an atrocity”, adding “they take almost nothing and we take everything from them”.

But while trade imbalances and the money that can be raised from tariffs are on his mind, his immediate concerns are to do with illegal immigration and the importation of the deadly opioid fentanyl into the US via its southern and northern borders.

By weaponising the US’s strength as a trading partner and threatening tariffs on Canada and Mexico, he has successfully gained agreements from them to significantly strengthen border security – an aggressive approach, many would suggest but one which appears to have paid off.

It was an approach trialled last month when Washington forced Colombia to accept deportees, which it initially argued against, by threatening a 25% tariff.

These latest moves were a bigger gamble, though, because Colombia accounts for roughly 0.5% of US imports whereas nearly 30% of all US imports hail from Canada and Mexico.

A trade war would have been highly damaging to those countries but it would also have had a negative impact on the US, with many commentators suggesting it could have led to supply chain disruption and higher prices for consumers.

The Washington DC-based Peterson Institute for International Economics,

an independent research organisation, said its analysis finds the tariffs would damage all the economies involved, including the US.

It should also be noted many US businesses have operations in one or other of the countries targeted by their President.

US meat heavyweight Smithfield Foods recently raised less than it anticipated from an IPO with speculation suggesting the threat of tariffs on imports into the US could have had an impact on its plans.

Smithfield, which identified tariffs as a risk factor in its IPO prospectus, has operations in Mexico where it employs around 2,500 people.

Such corporate discomfort was evidently a price Trump was willing to pay.

“We may have short term some little pain, and people understand that. But long term, the United States has been ripped off by virtually every country in the world,” Trump is on record as saying.

Or perhaps he was always confident his counterparts in Canada and Mexico would blink first.

Could the US president be talked out of tariffs?

Trump says tariff is his favourite word but, if he believes by imposing the measures he can boost the US economy, protect jobs and raise tax revenue, wiser heads around him may convince him otherwise.

Trade bodies and economists have warned tariffs hit businesses and consumers on both sides.

Break trade and you disrupt global capital flows necessary to finance the US budget deficit

Steven Blitz, TS Lombard

William Bain, head of trade policy at the British Chambers of Commerce, said: “More tariffs mean less trade, mean higher prices, mean lower consumer demand … there are not any economists that we see on this side of the Atlantic who seem to be saying that you can bring in these tariffs and see global trade increase.

“So global trade is likely to go into reverse if this happens. A protracted and expanding trade war is something we’d all want to avoid. But if it happens, we’re simply going to see less cross border trade and that will have a significant impact on global growth.”

Steven Blitz, chief US economist at economic forecasting consultancy TS Lombard – owned by Just Food’s parent company GlobalData – said: “Breaking global trade may seem like the thing to do to resurrect the US industrial economy, a noble ambition, but break trade and you disrupt global capital flows necessary to finance the US budget deficit.”

What might be the impacts on the food-and-beverage sector?

Uncertainty will remain for companies exporting to the US, knowing Trump has the tariffs threat in his locker.

At a more macro level, Canada may well start to look more closely at its food security.

Dr. Sylvain Charlebois, a professor and researcher of food distribution and policy at Dalhousie University in Canada, speaking before Trump paused the tariffs on imports from the country, said: “As a nation that prides itself on food security and a robust agricultural trade surplus, Canada now faces a critical test of its ability to remain competitive in an increasingly protectionist global economy.”

The introduction of tariffs would exacerbate existing challenges within Canada’s food and drinks industry, Dr. Charlebois argued, including “high logistical costs due to its vast geography, regulatory obstacles for small businesses and the lack of strategic investments in value-added processing”.

The need for Canada to build stronger trade alliances beyond the US has never been more urgent

Dr. Sylvain Charlebois, Dalhousie University

He also called for trading alliances with other countries to be strengthened.

“With American tariffs cutting deep into exports, the need for Canada to build stronger trade alliances beyond the US has never been more urgent … the government must act decisively to enhance domestic food processing capabilities and expand export markets in Asia, Europe, and the Middle East,” he said.

In Canada, a type of soft protectionism is springing up via an informal ‘buy Canadian’ campaign that might be seen as the result of both anger at Trump’s threat and a desire for self-preservation.

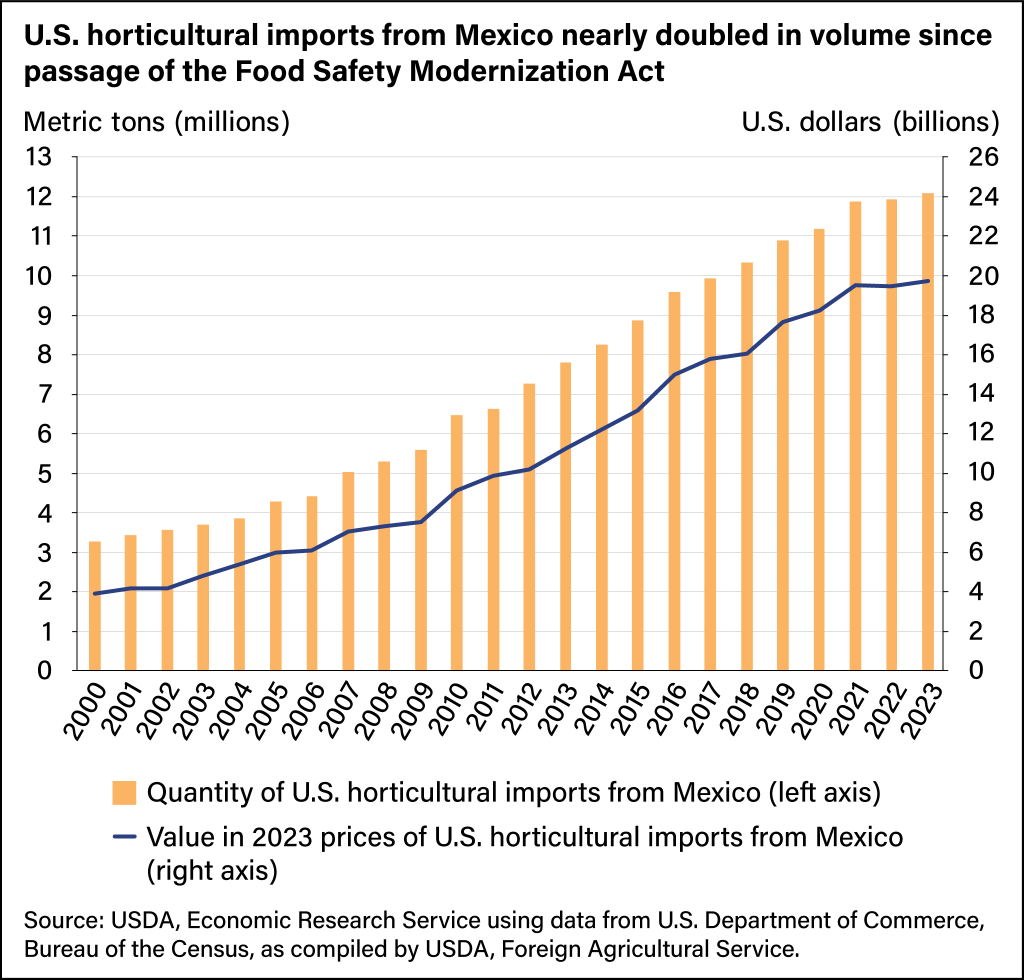

Mexico, too, will likely be concerned about its reliance on trade with the US – its largest trading partner. In 2023, the US bought more than $45bn in agricultural products from Mexico, including 63% of imported vegetables and 47% of fruits and nuts.

As for individual companies, some are unwilling to sit around to find out how the tariffs trade-off will eventually play out.

US spirits company Luxco has brought forward its transatlantic shipping schedules of American whiskey amidst uncertainty about trade tariffs.

Greg Mefford, managing director of international business at the St Louis-based company, said: “The inventory that we had scheduled for shipping in quarters two and three this year will now arrive in Europe before the end of March. We’re going early to minimise how any future changes in trade tariffs impact the pockets of American whiskey fans across Europe and the UK.”

Other companies, which count the US as a major export market, may decide it is worthwhile following Trump’s ‘advice’ and carrying out more of their production there.

At the end of last month, French luxury heavyweight LVMH Moët Hennessy Louis Vuitton was said by news agency Reuters to be “seriously considering” bulking up its production capacities in the US.

The Glenmorangie whisky and Hennessy Cognac owner’s CEO Bernard Arnault was quoted as saying: “It’s clear that we are being strongly pushed by the American authorities to continue to build out our presence. In the current context, this is something that we’re looking at seriously.”

Likewise, Australia-based Yowie Group is re-evaluating its supply chain in response to the threat of US tariffs.

Yowie sources chocolate and packaging from Canada and imports toys from China for its US production facility. It said this week it plans to source chocolate from the US in the future.

More broadly, food and beverage companies in the EU will be wary of Trump’s threat of tariffs on the bloc.

Some 20 EU member states exported more to the US than they imported in 2023. According to Eurostat, the EU’s statistics agency, the country with the largest surplus was Germany, followed by Italy and Ireland.

Trump seems most concerned about Germany’s exports of cars and machinery but food and drink exports could conceivably be hit by a blanket introduction of tariffs.

He seems less concerned about the UK although the trade picture here is quite blurred.

According to the Financial Times, US figures show the country ran an overall trade surplus with the UK in 2023, amounting to $14.5bn. However, the UK’s Office for National Statistics reports the UK ran a trade surplus with the US of £71.4bn ($89bn) that year.

A side effect of EU-based food and beverage companies having to pay tariffs on exports to the US could be a general spiral in food and beverage inflation, which could see costs passed on to buyers in other key markets they supply, such as the UK.

Concerns within the US

As far as the US is concerned it should be remembered that it is not foreign countries that pay tariffs but the importing companies that buy the goods with retail giants such as Walmart, for example, paying tariffs directly to the US Treasury.

If tariffs were to be introduced, in future they will have the choice of no longer buying the foreign-produced goods, thereby limiting consumer choice, taking the additional ‘hit’ themselves or passing them on to customers by way of higher prices.

Leslie Sarasin, president and CEO at US food industry association FMI, believes it would be the latter.

“New tariffs will also drive up the cost of doing business and food prices at a time consumers are extremely concerned about prices,” he said.

The US Chamber of Commerce, agreed, saying tariffs will “only raise prices for American families and upend supply chains”.

The trust and credibility in the US as a stable and predictable trading partner has been critically damaged

John Foraker, Once Upon a Farm

US food and beverage manufacturers that supply China will also be wary of the tariffs it has imposed on American goods being expanded to cover the products they make or process.

Showing signs of frustration with recent developments, well-known food entrepreneur John Foraker believes the events of recent days will have ramifications years from now.

Foraker is the co-founder of US infant-nutrition business Once Upon a Farm and led led the sale of the Annie’s business to General Mills for $820m in 2014. He said: “Ten years from now, economists will look back at these specific dates and will see that the harsh uncertainty unleashed on business leaders globally will have spawned lasting and very significant effects on business and global trade flows.

“Most businesses will not stop working on the plans they developed over the weekend, not at all. The trust and credibility in the US as a stable and predictable trading partner has been critically damaged.

“Companies on both sides of the borders now are much more likely to make risk-adjusted decisions that they probably would not have even considered prior – where to manufacture, where to source, how to price, where to cut, where to grow, etc., etc.”