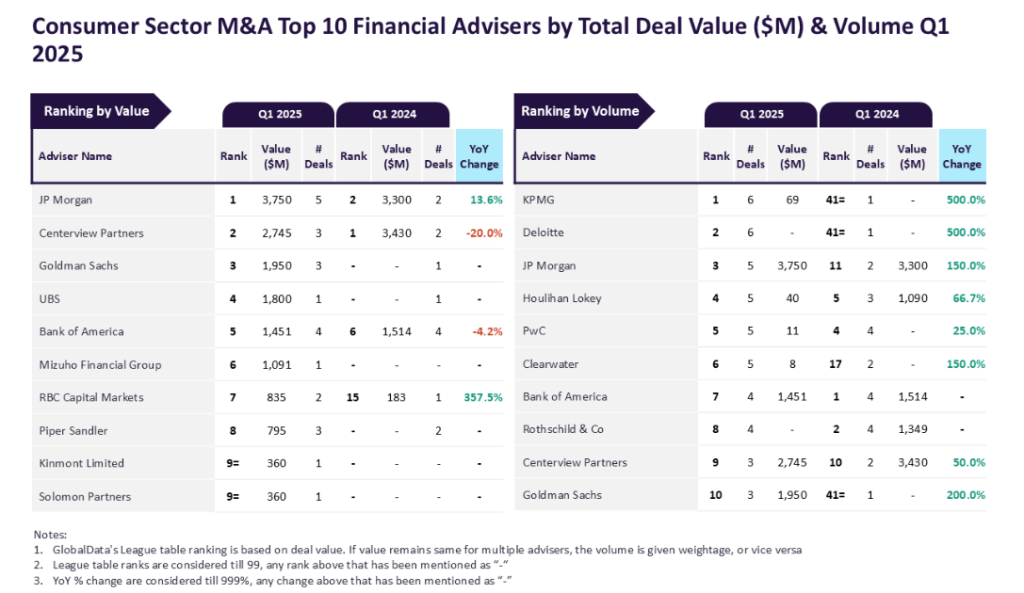

JP Morgan and KPMG lead two league tables devised by GlobalData after analysing the M&A that took place in the consumer sector in the first quarter of the year.

According to GlobalData, the parent company of Just Drinks, JP Morgan topped the list when measuring the value of transactions, while KPMG recorded the most deals by volume.

JP Morgan secured the top position on the value chart by advising on five transactions in the consumer sector worth a combined $3.8bn. Among the deals the bank worked on was Gryphon Investors’ move to acquire a majority stake in US sparkling teas and hard seltzers business Spindrift Beverage Company.

KPMG, meanwhile, led in terms of deal volume after providing advisory services for six deals. The professional-services group worked on transactions including meat giant OSI Group’s deal to buy UK peer Karnova Food Group from private-equity firm Endless.

GlobalData lead analyst Aurojyoti Bose said: “There was an increase in the number of deals advised by KPMG during Q1 2025 compared to Q1 2024. Its ranking by volume also took a leap from 41st position in Q1 2024 to the top position in Q1 2025.

“Meanwhile, JP Morgan’s ranking by value improved from the second position in Q1 2024 to the top spot in Q1 2025 primarily attributed to its involvement in some big-ticket deals.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“During Q1 2025, it advised on two billion-dollar deals, which helped it register growth in total deal value and improvement in its ranking by this metric as well. Apart from leading in terms of value, JP Morgan also held the third position by volume in Q1 2025.”

Centerview Partners ranked second in terms of deal value, advising on deals totalling $2.7bn.

Goldman Sachs followed with $1.95bn, UBS with $1.8bn was fourth and Bank of America rounded out the top five on the value list after working on deals worth $1.45bn.

In terms of deal volume, Deloitte ranked second, followed by JP Morgan, Houlihan Lokey, and PwC.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources. A team of analysts gathers in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.