Tahini, roselle and Valencia Orange are among a clutch of flavours and ingredients touted to drive NPD in the beverage-alcohol industry this year.

Ai Palette, a Singapore-based business that seeks to help CPG brands predict market trends, has identified a group of six flavours and ingredients it believes offer opportunities for alcohol brands to attract drinkers.

The beverage-alcohol sector is facing significant challenges, including changes in consumer habits and growing competition from alternative products.

More consumers are paying more attention to the links between what they eat and drink and their health, leading to growing interest in moderation. Recent cost-of-living pressures have also slowed the momentum of the ‘premiumisation’ trend, the theory that even if increasing numbers of people around the world are looking to drink less, they will spend more when they do.

Against that backdrop, brand owners face an intensifying battle to attract custom. Developing new products is a key weapon but risky.

Ai Palette, like Just Drinks, is owned by GlobalData. The UK-based research and analytics group analysed Ai Palette’s database to identify one “stand-out ingredient” across six geographic markets – the US, Canada, the UK, South Africa, India and Australia.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEach ingredient is classified as having “high growth” and “high engagement” based upon consumers interactions with them across social media, retail and restaurant industry sites over recent years.

In a research report, GlobalData has placed each ingredient into an ingredient family, provided suggestions on ingredient pairings and reviewed how brands can use the ingredients in their products.

GlobalData said the key market for tahini is the UK, with roselle the principal ingredient of interest in Canada and Valencia Orange over the border in the US.

Alongside those ingredients, the analysts selected olive as of interest to product developers selling in South Africa, white pepper for NPD teams in India and finger lime for research execs in Australia.

“Leveraging these emerging ingredients and conceptual flavours allow alcoholic drink brands to target novel, experiential and health-conscious consumers thereby gaining a competitive edge,” GlobalData consumer sector analyst Alice Popple-Connelly says.

The engagement score GlobalData gives to an ingredient is based on the number of data points in the month. Growth is then calculated based on the increase of the monthly data points over the last two-year period to provide a two-year CAGR.

Tahini offers option for stout makers

Tahini, a creamy paste made from ground sesame seeds, is known for its nutty, earthy/woody and slightly bitter undertone.

Common in Middle Eastern, Mediterranean and north African cuisines, it is produced mainly in Lebanon, Israel, Turkey, Greece and Cyprus, using sesame seeds from Sudan, Ethiopia, India and China.

Tahini is a common ingredient in dressings and sauces, although its development in the alcoholic drinks category is in its infancy and limited. Rich in healthy fats, protein, calcium and iron, tahini’s versatility and health benefits are driving its popularity.

According to GlobalData, a promising opportunity for tahini in drinks lies in the buoyant UK stout market, which is expected to achieve a 14.2% CAGR from 2020 to 2029, the company’s researchers say. They point to US brewer Rogue Ales & Spirits, which incorporated the flavours of tahini into its 2022 Santa’s Private Reserve stout. Product developers could also pair tahini’s nutritional profile, creamy texture and neutral colouring with tangerine and honey.

Roselle appeal for fans of floral

Rosella hibiscus (Hibiscus sabdariffa) is a plant known for its red calyces, which are often used in herbal teas, health drinks and tonics. It has a tart flavour and is rich in vitamin C and antioxidants.

In recent years, roselle juice has become more popular as a drink. Once mainly used in traditional herbal remedies, it is now sold in bottled drinks and mixed into fruit-based beverages. More companies are using roselle juice in functional drinks aimed at hydration, digestion and heart health, GlobalData says.

The researchers argue roselle hibiscus can particularly appeal younger consumers, who are more likely to experiment with new and unconventional flavours in alcoholic beverages.

Roselle has not yet been commercialised in the alcoholic beverage industry, with its use centred on functional products, including herbal teas.

The presence of roselle hibiscus is still emerging but, as younger legal-age drinkers look for new taste experiences, the demand for floral flavours in alcohol, including roselle hibiscus, may spark product developers to use the ingredient.

Valencia Orange could ride citrus wave

A summer variety of Citrus sinensis, the inclusion of Valencia Orange in alcoholic beverages is growing in demand in the United States, where consumers express a preference for sweet flavours in wines, beer and cider, according to GlobalData.

Citrus flavours are already widely used in the spirits industry, which the analysts argue underlines the potential for Valencia Orange. “The zestful and refreshing nature of citrus can complement and elevate the complexity of spirits, making it a sought-after flavour profile,” they write in the report Emerging Flavors & Ingredients in Alcoholic Beverages.

GlobalData’s analysts, however, express a note of caution. They point out that the inherent sweetness of the Valencia Orange could pose a challenge to its more widespread acceptance in North America. “While sweetness is desirable to a substantial segment of the market, it may not resonate with all consumers, particularly those who favour less-sweet profiles in their alcoholic beverages,” they write.

Nevertheless, the report notes how Valencia Orange is already being used by alcohol NPD teams, including those at Molson Coors Beverage Co., wine brand Tarongino-Frizzante and distiller Luxco.

Olive has wide appeal

The inclusion of olives as an ingredient and flavour in alcoholic beverages is “up-and-coming”, GlobalData contends, due to its unique taste profile, with South Africa emerging as a key market. Orange is one pairing suggested, as well as rosemary and lemon.

Interestingly, the analysts assert that the use of olive oil in alcoholic beverages may attract different consumer cohorts. “Older generations, such as Baby Boomers and Gen X, tend to gravitate toward products with simpler ingredients,” the report says.

Those cohorts are “health-conscious individuals” and prefer drinks with “fewer additives and more natural, recognisable ingredients”, it adds.

GlobalData points to a consumer survey it conducted last year that showed 52% of Boomers agree that they prefer products with as few ingredients as possible, compared to only 37% of Gen Z. The group’s consumer surveys cover 42 countries and include responses from over 21,000 people

Younger consumers, including Millennials and Gen Z, could be drawn to olive oil in alcoholic beverages “for its novelty and health benefits”, the researchers say.

The survey results also indicate one reason why GlobalData linked olive to South Africa. In the survey, the Middle East & Africa region placed the highest importance on ‘natural’ products, with 43% of consumers indicating it as essential – a figure higher than any other region globally, the report said.

White pepper’s “versatility”

Often used as a conceptual flavour descriptor rather than an actual ingredient in alcoholic beverages, white pepper is widely used in various culinary traditions.

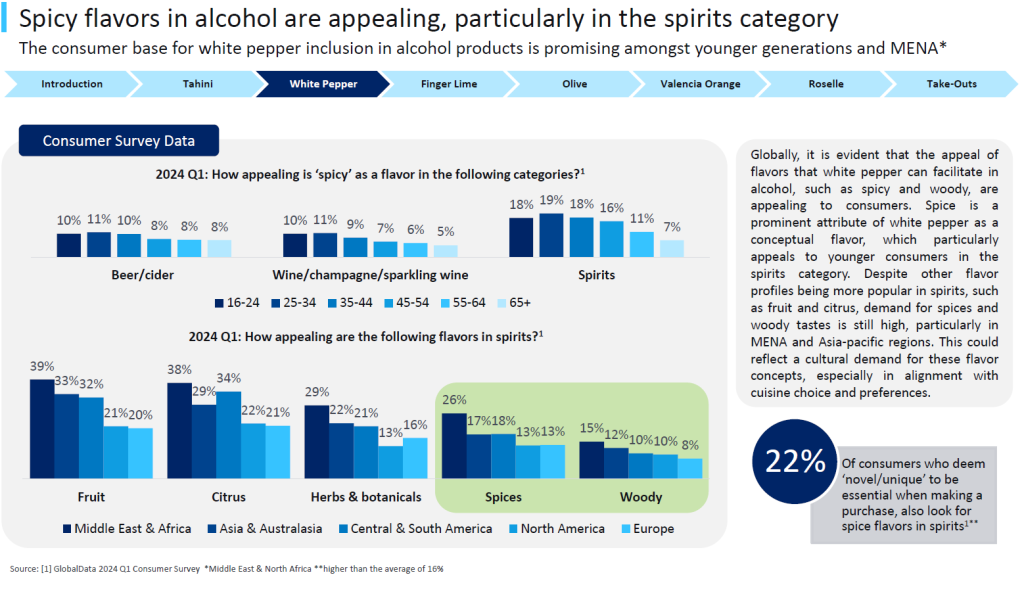

Fruit and citrus flavours may be more popular but the appeal of flavours that white pepper can facilitate in alcohol, such as spicy and woody, are appealing to consumers and demand for them is high in the MENA and Asia Pacific regions, GlobalData says.

The report presents a “case study” of the use of white pepper as an ingredient, which, interestingly, features a non-alcoholic cordial from Paragon, a brand owned by French business Monin.

The drink uses pepper varieties from Cameroon, Ethiopia and Nepal. “The introduction of the Paragon White Penja Pepper Cordial is set to inspire a wave of innovation across the beverage industry, from non-alcoholic to alcoholic offerings. By showcasing the versatility of White Penja pepper in a cordial format, Paragon is paving the way for other brands to explore the potential of this exquisite spice,” the researchers say.

Finger lime can prove handy for “premium” products

Primarily grown in Australia, finger limes have been cultivated in California and other sub-tropical regions.

In the citrus world, finger lime is most comparable to lime in terms of acidity but has a texture closer to passion fruit seeds. It has been used as a garnish in cocktails or desserts but is also valued for its health benefits.

Of course, citrus flavours already hold a strong position in the beverage-alcohol market, especially spirits, but the report contends that could make finger lime a promising option in high-consuming spirits markets like the UK and in Australasia.

Rarer than conventional lime and with a stronger flavour, finger lime can be positioned as a “premium” ingredient, aligning with Millennials, who, GlobalData says, are the most willing to spend on luxury alcoholic drinks.

Citing one of their consumer surveys from 2023, the researchers say 53% of Millennial consumers indicate they will either “start buying, continue to buy, or buy more frequently luxury alcoholic beverages”.

Younger consumers favour bold, innovative flavours and are more open to trying new options compared to older demographics, the analysts add. That said, its flavour profile could also cater to an older consumer base, appealing to those seeking premium, refined, citrus notes in their drinks.

Products using the ingredient are primarily found in Australia, including a spiced ginger beer and finger lime RTD from Urban Rum Distillers, which the company markets under its Brix brand. Archie Rose Distilling Co. also offers a finger lime-infused gin in its range of spirits.

For any questions or further enquiries about this report or GlobalData’s Ai Palette innovation and consumer insights platform, please contact GlobalData here.