Post-pandemic, the survival of many traditional retailers in developing countries is at risk. Changes in consumer shopping habits and the rapid advances in technology are driving the growth of food and drinks sales online in direct competition with their own businesses.

Consequently, traditional retailers will see their share of the retail grocery market in developing countries fall over the next decade. This should be of concern to the drinks industry as the channel accounts for a sizeable share of their sales. In India, the traditional channel accounts for more than two-thirds of the sector’s Rs1trn of sales.

“Smartphones have made consumers very savvy and knowledgeable about the products they want to buy, providing instant access to online information and ultimately another place to buy a product from. Traditional retailers must adapt their business model to offer a hybrid offline and online retailing experience because to today’s consumers, buying instore or online is now one seamless shopping experience,” Sumit Joshi, a beverages consultant for GlobalData’s consumer custom solutions practice, says.

While the competitive pressures are undeniable, traditional stores – also known as kiranas in India and ‘mom-and-pop’ stores elsewhere – maintain a dominant presence in the retail grocery market in developing countries due to their significant penetration of local consumer spend.

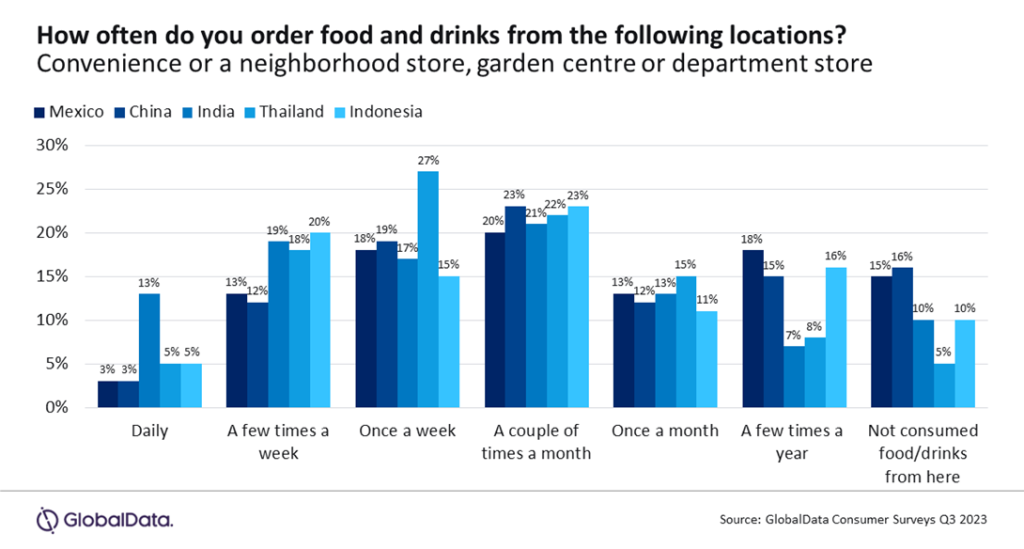

Over two-thirds of consumers in developing countries, including Mexico, China, India, Thailand, and Indonesia, regularly purchase food and drink products – on a ‘daily’ to ‘once a month’ frequency – from traditional retail stores, according to a global consumer survey conducted by GlobalData, Just Drinks’ parent, in the third quarter of the year. At least two-thirds of these consumers make frequent purchases, with most making two to four purchases a month.

Traditional stores achieve this level of customer loyalty by developing strong interpersonal relationships with shoppers, which offers a significant point of difference to online and national retail chains. They also serve as social hubs for local communities and function as sources of informal credit, particularly in rural areas. These relationships provide them with an unparalleled understanding of local needs and preferences, which they use to offer their shoppers a very personalised range of products and services which often translates into last-minute impulse purchases, increasing sales.

In another boost to the sector, per capita income has increased in a number of developing countries. In India, it has doubled in almost a decade, rising from approximately $1,050 in 2014-15 to $2,110 in 2022-23. This growth has made products more accessible in non-urban areas and given rise to a burgeoning middle class, which is projected to grow from 432m people (approximately 31% of the total population) in 2020-21 to 715m (47% of the population) by 2030-31, according to India’s National Statistical Office (NSO).

“These middle-class consumers typically have higher levels of disposable income than other population groups and represent a significant opportunity for traditional retailers and the beverage brands that they sell,” Joshi explains.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHow drinks brands can help retailers win in-store and online

Despite some positive signs for traditional retailers, remaining a purely retail business over the medium to long term is unlikely to be a viable proposition when faced with competition from e-commerce.

According to the Indian government, more than 12m sellers earn their livelihood by selling or reselling products and services. However, only 15,000 of these sellers (0.125% of the total) have enabled e-commerce, which highlights how far behind the traditional retail industry is in embracing online sales.

There are five key steps traditional retailers could take in their transition to a hybrid, offline/online business model. These efforts could be supported by the drinks industry:

Aggregator platforms

These tech-driven solutions are enabling traditional retailers to digitise their operations and offer customers online ordering and delivery services. Initiatives like the Indian government’s Open Network for Digital Commerce (ONDC) provide an e-retail platform for small businesses to buy and sell goods online.

Training and development

The National Skill Development Corporation (NSDC) in India has partnered with Coca-Cola India to offer retailers essential training on how to enhance consumer experiences and look at different approaches to expanding their business.

Merchandising excellence

Traditional retailers must deliver best-in-class merchandising with strong product placements, eye-catching displays, and well-organised store layouts to make shopping in their stores an easy and enjoyable experience for their customers.

Billing and payments

Offer streamlined barcode scanning for seamless billing, and convenient checkout options with multiple payment gateways, including debit/credit cards, mobile wallets, and leveraging cutting-edge technology, particularly through the adoption of a Unified Payments Interface (UPI) and the integration of e-commerce applications.

In-store experiences

Tech investments such as AR/VR could be considered by larger traditional retailers to provide in-store experiences beyond traditional shopping, focusing on in-person interactions and enhancing the relationship between brand and consumer.

“National grocery chains and the e-commerce giants present a formidable challenge to the traditional retail sector in developing countries. Their buying power alone enables them to offer pricing levels that in most cases the sector is simply unable to match. As they can’t compete on price, traditional retail stores should play to their strengths by digitising their operations to offer the convenience of online ordering and delivery services combined with a traditional retail experience with the exceptional levels of personal service that they excel in,” Joshi says.

“This hybrid service is what consumers are now looking for and, given the channel’s importance to drinks sales in developing countries, the more the industry can support these efforts the more promising the future outlook will be for both sectors.”