The consumer industry continues to be a hotbed of patent innovation. Activity is driven by convenience, environmental sustainability, health and wellness, aesthetics, as well as the growing importance of food safety and transparency, personalized nutrition, and technologies such as 3D food printer and digital food management. In the last three years alone, there have been over 52,000 patents filed and granted in the consumer industry, according to GlobalData’s report on Innovation in consumer: beverage pods. Buy the report here.

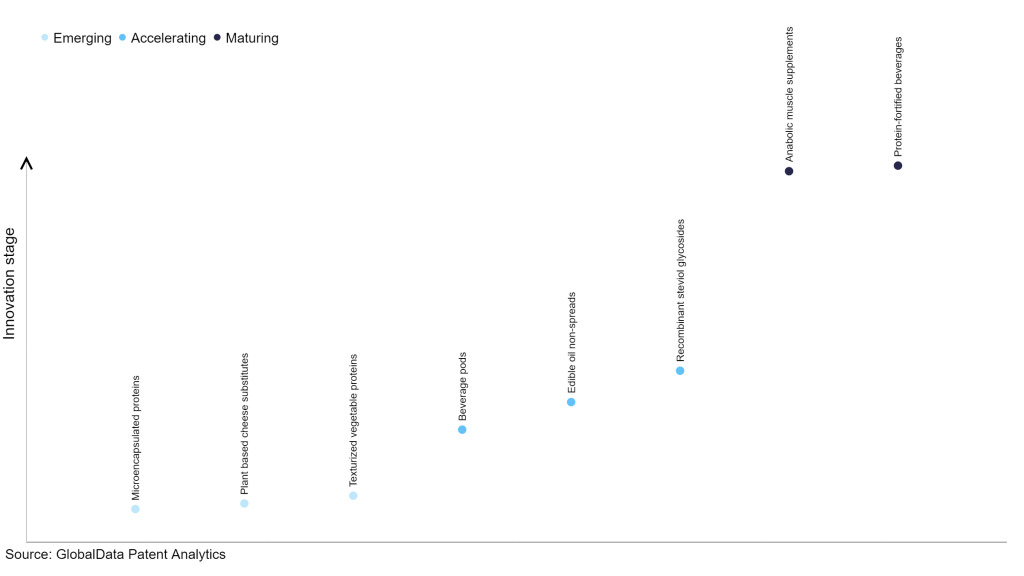

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilizing and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

30+ innovations will shape the consumer industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the consumer industry using innovation intensity models built on over 12,000 patents, there are 30+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, microencapsulated proteins, plant based cheese substitutes, and texturized vegetable proteins are disruptive technologies that are in the early stages of application and should be tracked closely. Beverage pods, edible oil non-spreads and recombinant steviol glycosides are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are anabolic muscle supplements and protein-fortified beverages, which are now well established in the industry.

Innovation S-curve for the consumer industry

Beverage pods is a key innovation area in consumer

Beverage pods house all the ingredients that are required to prepare a particular beverage. Water is added to the ingredients to create the final product.

GlobalData’s analysis also uncovers the companies at the forefront of each beverage pods and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 15+ companies, spanning technology vendors, established consumer companies, and up-and-coming start-ups engaged in the development and application of beverage pods.

Key players in beverage pods – a disruptive innovation in the consumer industry

‘Application diversity’ measures the number of applications identified for each patent. It broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of countries each patent is registered in. It reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to beverage pods

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Freezio | 360 | Unlock Company Profile |

| PepsiCo | 80 | Unlock Company Profile |

| JDE Peet's | 73 | Unlock Company Profile |

| Anheuser-Busch InBev | 36 | Unlock Company Profile |

| Kraft Heinz | 32 | Unlock Company Profile |

| Nestle | 20 | Unlock Company Profile |

| Tyson Foods | 15 | Unlock Company Profile |

| AB Electrolux | 14 | Unlock Company Profile |

| Robert Bosch Stiftung | 10 | Unlock Company Profile |

| Mondelez International | 8 | Unlock Company Profile |

| Royal DSM | 8 | Unlock Company Profile |

| Midea Group | 6 | Unlock Company Profile |

| Coca-Cola Europacific Partners | 5 | Unlock Company Profile |

| Pentair | 4 | Unlock Company Profile |

| Wework | 3 | Unlock Company Profile |

| Guangdong Midea Water Dispenser Manufacturing | 2 | Unlock Company Profile |

| Sara Lee | 1 | Unlock Company Profile |

| Procter & Gamble | 1 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Freezio is the leading patent filer in beverage pods. Some other key patent filers in the space include PepsiCo, JDE Peet's, Kraft Heinz, and Nestle. Recently, Nestle introduced a new coffee machine called Neo, which uses coffee pods that are paper-based, home-compostable and use 70% less packaging.

In terms of application diversity, Mondelez International leads the pack, while Pentair and Robert Bosch Stiftung stand in second and third positions, respectively. By means of geographic reach, Coca-Cola Europacific Partners holds the top position, followed by Guangdong Midea Water Dispenser Manufacturing and Wework.

Beverage pods will potentially become an important aspect in the consumer industry. With consumers increasingly seeking convenient and easy-to-prepare beverage products, beverage pods will gain increased acceptance among consumers.

To further understand the key themes and technologies disrupting the consumer industry, access GlobalData’s latest thematic research report on Consumer.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.