The consumer industry continues to be a hotbed of innovation, with activity driven by health & wellness, aesthetics, and environmental sustainability and growing importance of technologies such as food safety & transparency, personalised nutrition, and alternative proteins. In the last three years alone, there have been over 450,000 patents filed and granted in the consumer industry, according to GlobalData’s report on Innovation in Consumer: Legume-based milk alternatives. Buy the report here.

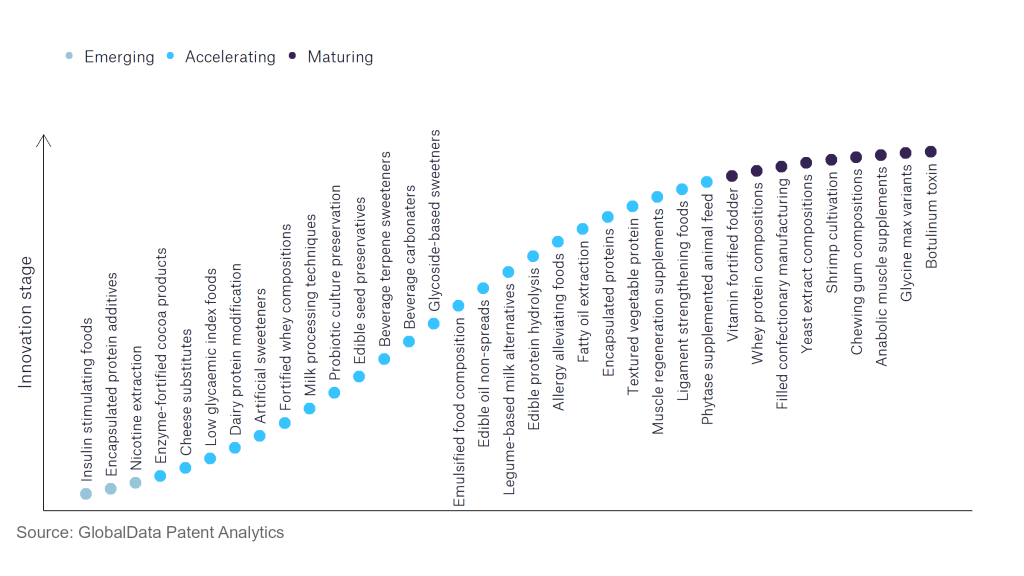

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

40+ innovations will shape the consumer industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the consumer industry using innovation intensity models built on over 110,000 patents, there are 40+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, hydrogel dressings, dextrin-based compositions, and safety injection needles are disruptive technologies that are in the early stages of application and should be tracked closely. Milk processing techniques, probiotic culture preservation, and glycoside-based sweeteners are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are chewing gum composition and shrimp cultivation, which are now well established in the industry.

Innovation S-curve for the consumer industry

Legume-based milk alternatives is a key innovation area in consumer

Leguminous plant-based milk alternatives are highly beneficial for consumers, as they are cholesterol-free, low in saturated fats, and high in proteins.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 20+ companies, spanning technology vendors, established consumer companies, and up-and-coming start-ups engaged in the development and application of legume-based milk alternatives.

Key players in legume-based milk alternatives – a disruptive innovation in the consumer industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to legume-based milk alternatives

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Otsuka Holdings | 68 | Unlock Company Profile |

| Givaudan | 56 | Unlock Company Profile |

| Raisio plc | 33 | Unlock Company Profile |

| Koninklijke Philips | 33 | Unlock Company Profile |

| Bayer | 31 | Unlock Company Profile |

| Nestle | 30 | Unlock Company Profile |

| Fuji Oil Holdings | 30 | Unlock Company Profile |

| Delek Group | 27 | Unlock Company Profile |

| J.M. Huber | 21 | Unlock Company Profile |

| JS Global Lifestyle | 17 | Unlock Company Profile |

| Royal DSM | 16 | Unlock Company Profile |

| Chr. Hansen Holding | 15 | Unlock Company Profile |

| Guangdong Xinbao Electrical Appliances Holdings | 14 | Unlock Company Profile |

| Symrise | 12 | Unlock Company Profile |

| nextProtein | 11 | Unlock Company Profile |

| Danone | 10 | Unlock Company Profile |

| AB Biotek | 10 | Unlock Company Profile |

| Kikkoman | 9 | Unlock Company Profile |

| CJ CheilJedang | 8 | Unlock Company Profile |

| Riken Vitamin | 7 | Unlock Company Profile |

| Inner Mongolia Yili Industrial Group | 6 | Unlock Company Profile |

| PepsiCo | 5 | Unlock Company Profile |

| DuPont de Nemours | 5 | Unlock Company Profile |

| Zuivelcooperatie FrieslandCampina UA | 5 | Unlock Company Profile |

| Novo Nordisk Foundation | 5 | Unlock Company Profile |

| Kraft Heinz | 5 | Unlock Company Profile |

| House Foods | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Otsuka Holdings is one of the leading patent filers in legume-based milk alternatives. Some other key patent filers in legume-based milk alternatives include Givaudan, Raisio, Koninklijke Philips, Bayer, and Nestle. Nestle recently launched a new brand named Wunda, marketing it as a milk alternative made from yellow peas. The product will be available in France, the Netherlands, and Portugal, with a consecutive rollout in other European countries. Wunda will be launched in three versions - original, unsweetened, and chocolate.

In terms of application diversity, Symrise leads the pack. JS Global Lifestyle and DuPont de Nemours stand in second and third positions, respectively. By means of geographic reach, Otsuka Holdings holds the top position, followed by Chr. Hansen Holding and Guangdong Xinbao Electrical Appliances Holdings.

Legume-based milk alternatives will see increased usage in the coming years with many consumers growing more conscious of their health and seeking plant-based milk alternatives. Companies must continue to innovate and launch more products to capture a larger share in the milk alternatives market.

To further understand the key themes and technologies disrupting the consumer industry, access GlobalData’s latest thematic research report on Consumer.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.