The consumer industry continues to be a hotbed of innovation, with activity driven by convenience, environmental sustainability, and health and wellness, and the growing importance of technologies such as digital food management, 3D food printer, food safety and transparency, and personalised nutrition. In the last three years alone, there have been over 450,000 patents filed and granted in the consumer industry, according to GlobalData’s report on Innovation in Consumer: Whey protein compositions. Buy the report here.

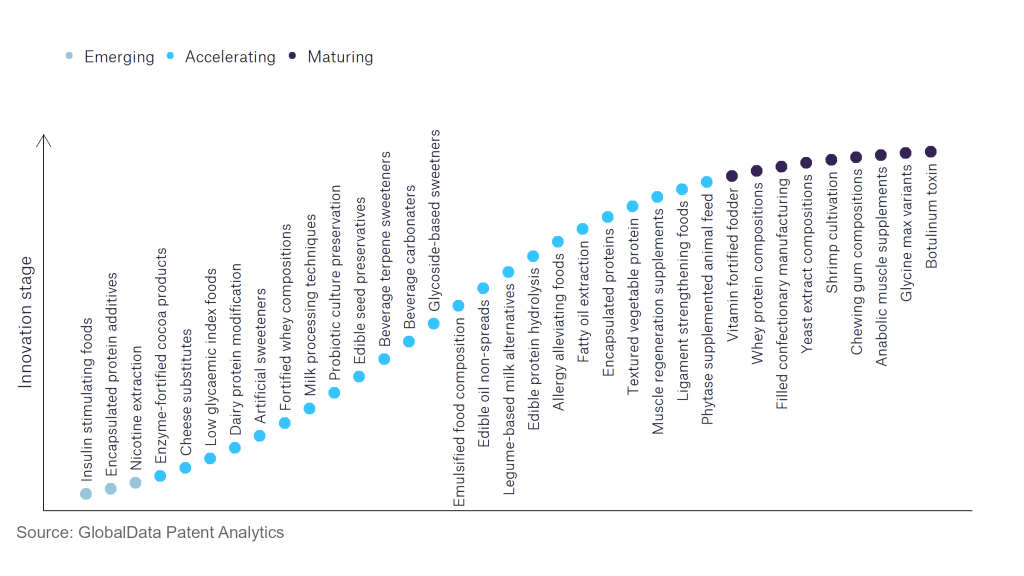

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

40+ innovations will shape the consumer industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the consumer industry using innovation intensity models built on over 110,000 patents, there are 40+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, hydrogel dressings, dextrin-based compositions, and safety injection needles are disruptive technologies that are in the early stages of application and should be tracked closely. Wet wipes dispenser, carbon fibre sports equipment, and cigarette rod making device are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are portable toothbrush cases and anabolic muscle supplements, which are now well established in the industry.

Innovation S-curve for the consumer industry

Whey protein compositions is a key innovation area in consumer

Whey protein refers to soluble milk proteins that are created from the by-product of cheese production. It is popularly consumed by athletes.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 20+ companies, spanning technology vendors, established consumer companies, and up-and-coming start-ups engaged in the development and application of whey protein compositions.

Key players in whey protein compositions – a disruptive innovation in the consumer industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to whey protein compositions

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Arla Foods amba | 85 | Unlock Company Profile |

| Valio | 65 | Unlock Company Profile |

| Nestle | 59 | Unlock Company Profile |

| Megmilk Snow Brand | 58 | Unlock Company Profile |

| Danone | 54 | Unlock Company Profile |

| a2 Milk | 53 | Unlock Company Profile |

| Reckitt Benckiser Group | 50 | Unlock Company Profile |

| Fonterra Co-operative Group | 33 | Unlock Company Profile |

| Zuivelcooperatie FrieslandCampina UA | 30 | Unlock Company Profile |

| Roquette Freres | 20 | Unlock Company Profile |

| Dairy Australia | 14 | Unlock Company Profile |

| INGREDIA | 12 | Unlock Company Profile |

| Leprino Foods | 12 | Unlock Company Profile |

| Murray Goulburn Co-operative | 9 | Unlock Company Profile |

| Morinaga Milk Industry | 7 | Unlock Company Profile |

| SiS (Science in Sport) | 7 | Unlock Company Profile |

| Agriculture Victoria Services | 7 | Unlock Company Profile |

| Tereos | 6 | Unlock Company Profile |

| Inner Mongolia Yili Industrial Group | 5 | Unlock Company Profile |

| Royal DSM | 5 | Unlock Company Profile |

| L’Institut National Recherche Agronomique | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Arla Foods amba is one of the leading patent filers in the whey protein compositions space. Some other key patent filers include Valio, Nestle, and Megmilk Snow Brand. Recently, Arla entered a partnership with First Milk. Under the new partnership, First Milk will produce specialist whey protein powder for Arla Foods.

In terms of application diversity, a2 Milk leads the pack, while Megmilk Snow Brand and Valio stood in the second and third positions, respectively. By means of geographic reach, Valio held the top position, followed by Dairy Australia and Ingredia.

Whey protein compositions will become an important aspect in the consumer industry, as the health and wellness trend gains further foothold.

To further understand the key themes and technologies disrupting the consumer industry, access GlobalData’s latest thematic research report on Consumer.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.