Alongside our daily news coverage, features and interviews, the Just Drinks news team sifts through the week’s most intriguing data sets to bring you a roundup of the week in numbers.

This week, we took a look at Britvic’s presence in France after it announced its full-year results, looked at the soft-drinks category’s potential in China as food-and-beverage group Tianyun International Holdings acquired a stake in Jianlibao Asia and analysed Australia’s falling harvest volumes.

Britvic touts France’s je ne sais quoi

France, Britvic’s largest export market by revenue, remains a “large and attractive market” despite slower growth, the soft-drinks company said this week.

While Great Britain retains the lion’s share of the company’s revenue – forming 68% in the 12 months to 30 September – France took 11%, above Ireland, which held 9%.

In the 12-month period, Britvic’s revenue in France inched up 0.5%, a consequence of a difficult trading year, the group said.

Despite high inflation and “extremely competitive market conditions”, CEO Simon Litherland stressed the company was “committed to France” and intended to rebuild margins in 2024.

He added: “We’re also going to increase our investment behind our core brand Teisseire in 2024. We’ve got a new marketing campaign that’s under development, and we’re also renewing our relationship with the Tour de France, which was very successful for us in the past. We remain committed to France.”

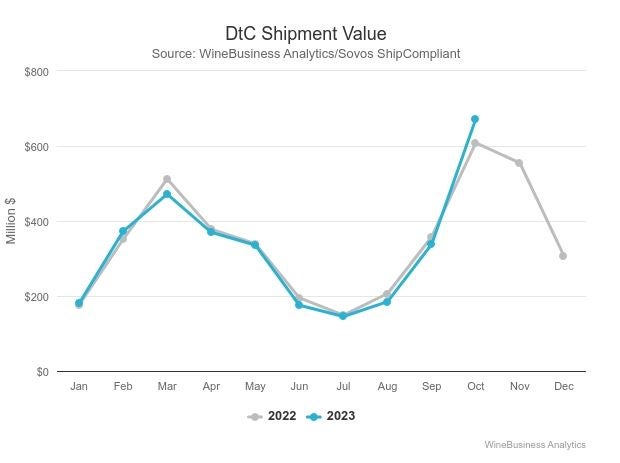

US D2C wine sales robust in October

North America’s total wine sales rose 10% year on year to $9.7bn in October, totaling $109.05bn in the full year, data shows.

The value of direct-to-consumer (D2C) wine sales in the US grew by 11% year on year to more than $672m in October, according to WineBusiness Analytics and Sovos ShipCompliant.

D2C sales saw a dip in volume, falling 1% to 875,738 cases. Average bottle prices hit a monthly record of $63.96 – a 12% hike – with California the biggest spender, buying $1.2bn worth of wine – 30% of the US’s total D2C sales. California’s spend was down 11% on its October 2022 figures, however.

“The shifts in value and volume versus a year ago occurred within seasonal shipment patterns, with the sharp gain in value attributable to October having five Mondays and typically being the strongest month of OND for shipments,” WineBusiness analysts said.

In the on-premise, meanwhile, sales dropped 2% to $940m and also fell 2% across the year.

It comes as US wine group Duckhorn Portfolio said it would focus on increasing the D2C presence of newly acquired Sonoma-Cutrer winery.

In a call with investors, Duckhorn Portfolio chief strategy and legal officer Sean Sullivan said: “D2C is a very small, nascent piece of [Sonoma-Cutrer’s] business. We have an exceptional D2C presence at our wineries, in our tasting rooms and through our club. We would expect to bring that, to augment Sonoma-Cutrer and capitalise on its great brand presence.

Duckhorn Portfolio last week struck a deal with Brown-Forman to acquire Sonoma-Cutrer for $400m.

Weak forecast for Czech beer market

The Czech beer market is forecast to see weak volume growth between now and 2027, analysis suggests.

Beer sales volumes are predicted to rise from 15.94mhl in 2023 to 16.5mhl in 2027, from 15.99mhl in 2018, according to GlobalData, Just Drinks' parent company.

If correct, it would see the category's CAGR at just 0.41% in 2027.

It comes as this week Czech soft-drinks manufacturer Kofola Group entered beer with the acquisition of local brewer Pivovary CZ Group.

Kofola Group has said beer is a “stable segment” with room for growth in export markets.

René Musila, co-founder and COO, said: “Our goal is to support the art and quality of Czech breweries. It would be a shame if traditional Czech brands were to fall into the hands of foreign investors.”

Sparkling future for soft drinks in China

China's soft-drinks market could hit $5.89bn by 2027 compared to $2.89bn in 2022, data suggests.

The market has remained steady for the last decade but analysis by GlobalData predicts it is set for a boom.

It comes as China food-and-beverage group Tianyun International Holdings this week acquired a minority stake in domestic sports drinks supplier Jianlibao Asia.

Hong Kong-listed Tianyun International said the deal “aims to combine the advantages and strengths of both parties in production, product promotion, market expansion and branding to create synergistic effects”.

Jianlibao’s namesake beverage was China’s first electrolytes sports drink and has a planet named after it, the statement said.

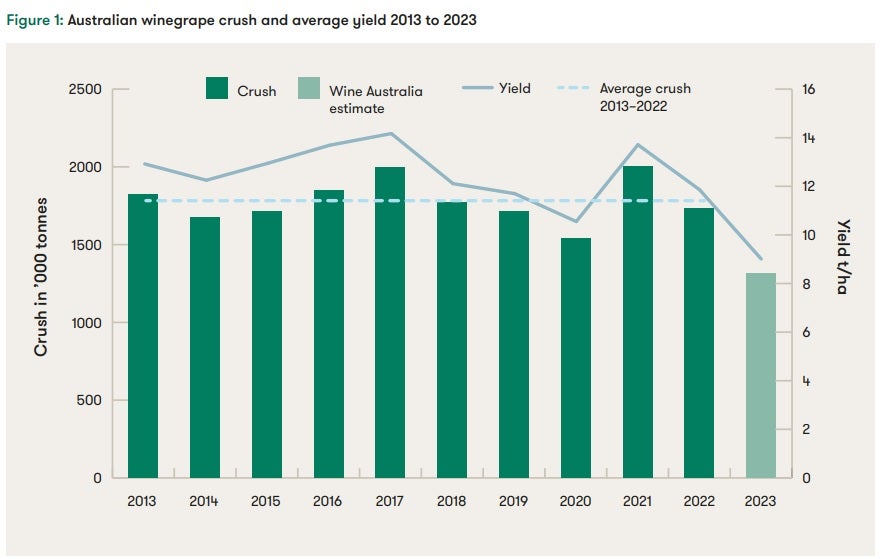

Record dip for Australia’s wine harvest

Australia’s wine harvest reached a 15-year low in 2022-23 as the industry attempted to tackle historically high inventory levels and challenging weather.

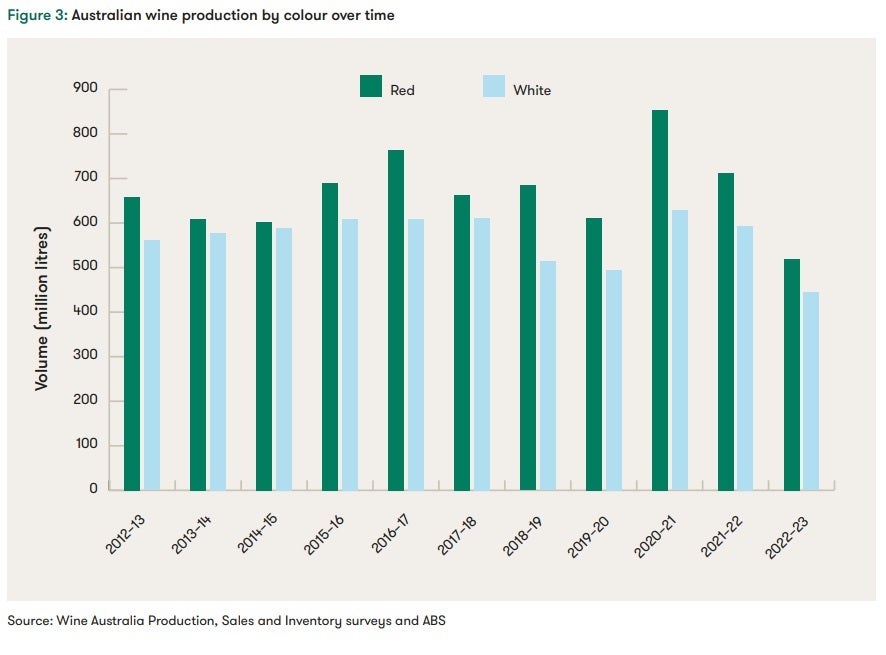

In the 2022-23 year, winemakers produced 964m litres, the lowest volume since the 2006–07 vintage and the first time it has fallen below 1bn litres since then, according to trade body Wine Australia.

Wine Australia put the small vintage down to “very difficult seasonal conditions, compounded by active steps by some growers and winemakers to reduce intake”.

Total sales of Australian wine were 11% above production volumes in 2022–23 but were “still not enough to substantially reduce pressure” on overstocks, Wine Australia said.

Australia’s total wine stock was estimated at 2.2bn litres on 30 June – which equated to 2.57 years’ worth of red wine and 1.49 years’ worth of white. The country’s storage capacity is approximately 3bn litres.

While 2022-23 sales surpassed expectations in volume terms, Wine Australia market insights manager Peter Bailey said “rebalancing supply and demand remains a real challenge” for the wine sector.