One in four wine and spirits bottles on supermarket shelves could be paper-based rather than glass within a decade, according to UK packaging company Frugalpac.

Surges in glass prices and consolidation in the glass industry should help boost interest in alternative packaging, CEO Malcolm Waugh told Just-Drinks at the ProWein trade fair in Germany in March. “I don’t think there’s a reason not to think you couldn’t see 20-25% of the market in some form of paper alternative – ideally Frugal Bottle – in the next decade.” Such a market share “could be more than possible”, he added.

Really? A quarter of wines and spirits in paper bottles, rather than glass, plastic or aluminium ones? It seems fanciful but some of the claims being made by the likes of Frugalpac have turned the heads of sustainability chiefs at major drinks brands. The glass they’ve traditionally used is heavy and energy-intensive to both produce and recycle, which means a sizeable chunk of the carbon footprint for the average bottle of wine, beer or other types of alcohol is the packaging.

At Carlsberg Group, for instance, manufacturing and disposal of packaging accounts for 45% of total greenhouse gas emissions (or around 2.3MtCO2e of 5.2MtCO2e) but reductions are proving hard to deliver.

In the brewer’s latest ESG report, emissions from packaging were down just 3% between 2015 and 2022. “We must work with our suppliers to further reduce emissions from glass and aluminium,” the report reads, and “look for opportunities to harness consumer interest in shifting to less carbon-intensive packaging alternatives”. Reuse is the most sustainable option in most cases but will take time; in terms of single-use it is paper that is attracting attention and investment.

With targets to meet within net-zero plans, something has to give. And maybe it is glass. In an email to Just-Drinks this week, Waugh highlighted the carbon credentials of his Frugal Bottle: the footprint is 91.9gCO2e, which is 84% lower than a 440g imported glass bottle (558.2g CO2e) and 34% lower than a bottle made from 100% recycled plastic (136.6g CO2e), he explains. It even beats the lightweight glass bottle made in the UK (382gCO2e) and has 77% less plastic than a plastic bottle.

Obviously on a roll, Waugh couldn’t resist a pop at the competition in the fibre-based bottle space, either. “The Frugal Bottle starts life from 94% recycled flat paperboard and 16% plastic, whereas other paper bottles are currently using 100% virgin pulp paper and up to 41% plastic,” he says.

Waugh’s sales pitch is obviously well-oiled. He also highlights the relevant life cycle assessments (LCAs) that potential drinks industry customers will (should) unpick in detail. Because this is not the only paper bottle in town: there are also consortiums working day and night to develop bottles – made mostly from paper and with plastic liners – that can meet the required specifications of the world’s biggest beverage brands.

A dose of reality

Tim Silberman is CEO at the Paper Bottle Co, Paboco, a start-up that is soon to launch into full-scale production at its manufacturing site in Slangerup, Denmark. The ambition is reportedly to produce over 20 million paper-based bottles by the end of next year; there are “newer and bigger” machines being installed right now. “Development always runs behind [what you plan],” he admits, with the beginning of next year now the target date for when things really start to ramp up.

Speaking to Just Drinks, Silberman carefully mixes desire with a dose of reality given the market he and his team are hoping to shake up. “We are not just looking at a replacement [for traditional packaging for drinks] but something that makes strategic and sustainable sense,” he says. And that means packaging which is not only different but which can also “make a difference”.

The bar being set by the brands is high. Packaging performance and speed, cost and carbon, all need to make sense. And the quality of any new format must be equal, if not better. Consumers also need to approve.

“Do I want to see Macallan put a 50-year-old whisky in a paper bottle? Of course not,” explains Tim Etherington-Judge, co-founder and chief sustainability officer at Calvados supplier Avallen Spirits, based in France, and founder of consultancy Avallen Solutions. But these new paper-based bottles “absolutely can compete” with more traditional formats, he adds.

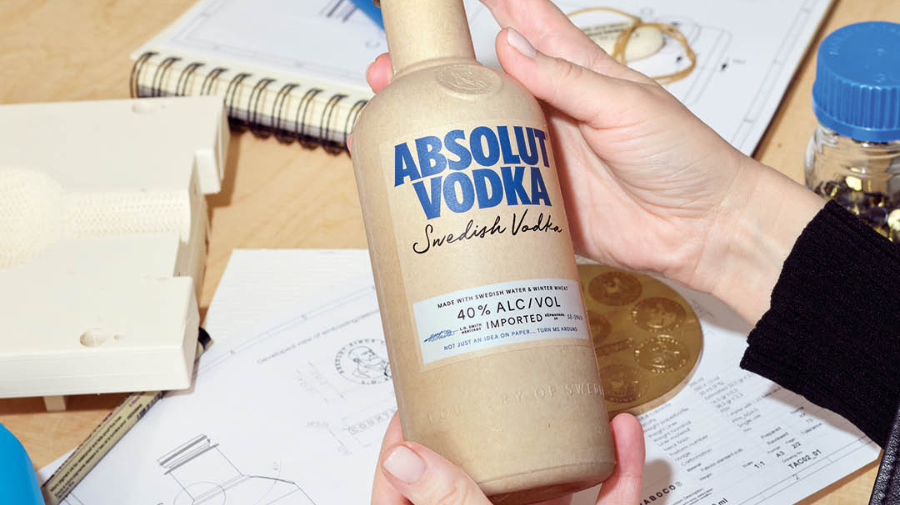

Pessimists point to the paper bottle Diageo promised in 2021 for Johnnie Walker whisky that has yet to hit shelves, for example (and appears to have been largely forgotten in its annual sustainability update of late). Others point out that some of the new packaging is basically a plastic bag in a bottle-shaped box – the Paboco paper-based bottle launched by Pernod Ricard for Absolut vodka 12 months ago consisted of 57% paper and 43% plastic.

Matilde della Fontana, a senior research associate at Lux Research based in Amsterdam, isn’t buying into the hype yet. Production remains low despite advances in pulp moulding methods, she says, while achieving high throughput in plants can often be hindered by the time needed for dewatering and drying each bottle. “Technologies such as dry moulding (being used by Pulpac) and impulse drying (being used by Paboco) will likely be more successful but they still can’t compete with the production speed of traditional plastic bottles,” Fontana adds.

Others also have their doubts. It all feels a little “short-sighted”, says Mariella Menato, head of sustainability and strategy director at international drinks branding specialist Denomination. “Shifting our dependency from one single-use format to an alternative single-use format maintains the overarching problem of our linear economy and its waste creation.”

Paper is recyclable but not infinitely in the same way that glass or aluminium is (paper degrades in quality and strength). “Recycling of paper requires a lot of water and a lot of chemical bleaching, so it comes with its own environmental impact,” Menato adds.

Shifting our dependency from one single-use format to another maintains the overarching problem of our linear economy and its waste creation.

Mariella Menato, Denomination

Research paper

Paper packaging producers have shied away from scrutiny, happy to let perceptions of paper as a clean, green option, prevail. They aren’t afraid of a fight, mind. The sector has fiercely (and successfully) lobbied against new packaging regulations at EU level that would have reduced the amount of single-use paper packaging on the market, despite major concerns about the evidence they presented to politicians (that’s why Frugalpac makes the most of its efforts to use recycled rather than virgin paper, however responsibly it is sourced).

“The supply chain for fibre is at the forefront of our minds,” says Silberman at Paboco, which uses FSC-certified wood fibres for its bottles. “We take this very seriously,” he explains, adding he is working with FSC on a “new initiative”, as well as other supply streams for the fibre needed to make the bottles. Campaigners will be watching closely as production increases – and should demand spike in the way Frugalpac’s Waugh forecasts.

Paboco trials are ongoing with the likes of Coca-Cola, Carlsberg and Absolut. The paper bottles for beer could bring in new female customers, according to reports, and bring down emissions, by using a bio-based PEF liner rather than one made from oil-based PET. PEF, like paper bottles, is a technology that promises much but has yet to really deliver on the big stage. Global packaging firm Alpla is now the major shareholder at Paboco and is thinking big with its next-gen container, available in 500ml and 330ml, which is reportedly 85% paper (14g) and 15% HDPE barrier (2.6g). The target is to reduce that liner to 5% to pacify paper mills and recycling firms.

“My view is that if a product could be made with a lower environmental impact overall than the incumbent format – which some of these solutions have demonstrated – [then] it’s an innovation worth pursuing,” says Roger Wright, waste strategy and packaging manager at Biffa, a waste contractor headquartered in the UK. However, a simple swap isn’t straightforward. “Many of the solutions you’ll see [can] pass the fibre recovery test at paper mills but testing at materials recovery facilities (to get the paper to the mills) is as yet inconclusive,” says Wright.

In a video spotlighting miniature paper bottles for Baileys, designed with PulPac and trialled in Barcelona this summer, Diageo senior global breakthrough innovation lead Michelle Atkinson explains how the 90% paper packaging is “really easily recycled in your paper waste stream, you don’t have to separate, you drop them straight in and they’ll be repulped”.

Maybe. Maybe not. The bottles are for example 3D while most paper recycling is 2D, which presents an issue, as can the plastic liner. The bottle prototypes passed the CEPI (Confederation of European Paper Industries) recycling test for paper repulping, according to Dave Lütkenhaus, global sustainability and innovation director at Diageo. “Initial LCAs show that they have a lower carbon footprint compared to PET and r-PET,” he notes. “We will conduct further LCAs to confirm these savings prior to any claims for scaled versions.”

There is also confusion over some of the new barriers that companies are trialling in a bid to replace plastic. Novel coatings are attracting a lot of interest but details are thin on the ground. The aqueous coatings some packaging producers are using on fibre can break down and become part of the fibre which can leave flecks in the final reprocessed products, for example.

That’s no good for those seeking high-end paper products from the likes of James Cropper. The specialist paper mill takes disposable paper cups, removes the plastic liner and turns them into luxury paper products, including moulded ‘wraps’ for brands like Maison Perrier-Jouët, one of France’s most historic and distinctive champagne houses, and Islay single malt Scotch whisky brand Bruichladdich, which is owned by Rémy Cointreau. “There is a lack of consistency,” explains Rob Tilsley, the company’s fibre specialist, during a tour of the Cumbria facility this month, which could recycle up to 700 million fibre-based coffee cups a year.

More than a thousand miles away, in Denmark, the Slangerup plant will initially churn out bottles for vitamin, supplement and beauty brands. These are easier wins than gins, beers and fizzy pop. Larger scale testing for drinks is earmarked for “next year”, Silberman says. The likes of Diageo, PepsiCo and Pernod Ricard are all also getting agonisingly close to this apparent Holy Grail of beverage packaging, reported the Wall Street Journal recently in a worthwhile read about the 100-year quest to make a paper bottle. “But putting liquids in paper is inherently challenging,” the author warned. For now, the champagne is on ice (and still comes in glass).