Hip Pop is a UK company marketing a range of “gut-friendly” soft drinks that was launched by founders Emma Thackray and Kenny Goodman in 2019.

The Manchester-based business, which employs around 20 staff, sold a combined 3.8m cans of its kombuchas and sodas in 2024 and is targeting 10m cans this year.

Hip Pop’s drinks are available in the UK and across the English Channel in Belgium and the Netherlands, with stockists including Sainsbury’s, Morrisons and Albert Heijn. Further afield, the company has a presence in Iceland, Dubai and in the US through an e-commerce platform selling into 45 states.

After making the drinks since the business started, Hip Pop’s founders begun outsourcing production in 2023. The company exports its products from the UK but, as it expands in Europe, it’s planning on having contract manufacturers there, too.

Thackray and Goodman are Hip Pop’s biggest shareholders, which has received around £7m ($9.1m) investment to date. Investors in Hip Pop include the founders of UK publisher Ladbible, three partners at Deloitte and BOL Foods owner Paul Brown.

Days before PepsiCo snapped up prebiotic soda brand Poppi in the US for almost $2bn, Just Drinks sat down with Hip Pop’s founders to discuss the company’s expansion plans, competition in functional soft drinks and its recent moves to redesign its range.

Eszter Racz (ER): The functional drinks market has become very competitive. How does Hip Pop stand out?

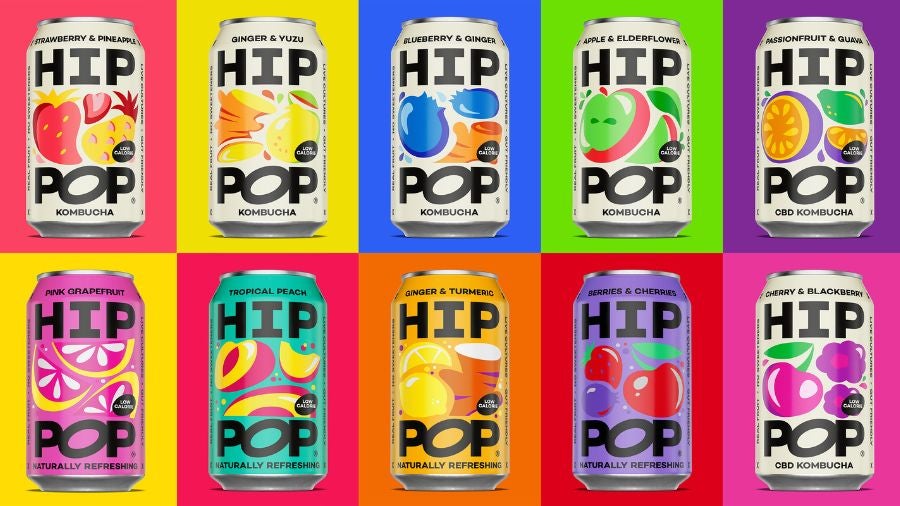

Kenny Goodman (KG): There’s two parts to it. There is getting people to take it off the shelves in the first place. Hence the branding. Our existing branding has served that purpose well. People do take off the shelf, they find it interesting but we have now decided that we want to be more ambitious and be even more striking.

Then there’s the repeat purchase rate. We have been told by Sainsbury’s we have well above average repeat purchase rate. That is down to the liquid in the can.

Our big thing is that we don’t want to be sweet. There are drinks out there that are sweet. That’s great because they tick the box for that consumer but we’re after the consumer that doesn’t want high sugar content. Some of these sweeteners, even stevia, are 200 times sweeter than sugar, so we don’t go down that path. All of our sodas are low sugar and low calorie as well. We use sugar because it’s real and it’s natural. You can tell any drink that’s got stevia in it.

JD: How do you think markets like Belgium and the Netherlands compare to the UK when it comes to functional drinks?

Emma Thackray (ET): In lots of ways, they are similar. When we went out to the Netherlands and looked at the brands in the supermarkets, we recognised a lot of the brands. One big thing that was interesting for us when we went to the Netherlands was that the supermarkets are formatted differently. They don’t have meal deals in the Netherlands, whereas we’ve got that in the UK.

KG: We’re launching in Morrisons and in the meal deal at Sainsbury’s, in over 300 stores. In the UK supermarkets, you generally start off in a four-pack in the back of store, and once you’ve earned your stripes they may take a risk on you and say: ‘Let’s put you in a single unit in the wellness chiller’, which is what happened with us in Sainsbury’s. And then we proved ourselves there. Then they say: ‘Right, we’re going to give you the meal deal now.’ That’s the progression work in the UK, whereas, in the Netherlands, you’re straight into single units. You are in the back of the store, but they’re single units, which drives trial. People are more likely to pick up a single can than a four-pack.

ET: It’s a big ask, isn’t it? To ask a consumer to pick up a drink that they might not have come across before and you are asking them to spend between £5 and £6, or even more, on a four pack of your drinks. It’s a big ask. We are really proud that we were able to drive trial and now the rebrand is about encouraging more and more people to pick up those boxes and then to help us get into the front of the store.

JD: On your sodas, what do you think will make consumers switch from mainstream brands like Diet Coke to Hip Pop?

KG: Functional drinks are growing at a much faster rate than general carbonated soft drinks. The data is telling us that people want something healthier but they still will want a treat. So my kids, when we go out for a meal, they still want a Coca-Cola, because it’s a great treat, but they will probably have less of that in general. That’s why Coca-Cola launched a healthy prebiotic pop in America called Simply Pop. That’s great for us because its engraining the word ‘pop’.

ET: But getting consumers to switch from the soft drinks they have been drinking all their life… for a lot of people that’s not going to start tomorrow. It’s a longer-term plan.

We have been doing our soda range since 2022. What we’ve found is the fruit-flavoured versions are really starting to encourage people to switch over, which is why we have doubled down on that.

Once you take a someone who’s drunk a big-brand diet pop their whole lives, the challenge is to getting them to try the natural alternative that we are. Once you do that, people are hooked.

JD: Where are you planning to focus your expansion efforts in the next two years?

KG: We’ve got some good traction in the Netherlands and Belgium. It just seems to be getting better. They want more SKUs and they are really happy with sales because it’s increasing.

ET: Beyond the Netherlands and Belgium, we’ve got a small but growing business out in Dubai, in the UAE. We have some business in Iceland. We’re talking to other distributors in other European countries. We have also started to look at the US, so we have a distributor out in the US now. The UK is our main focus but, when it comes to international expansion, we’ve had such good feedback from the markets that we’ve entered and from the sort of initial contacts that we’ve had that we are looking at that as a growth area. Because Europe is on our doorstep, right? And it’s exciting.

We’ve got really big ambitions. We want to break into the mass market

Emma Thackray

KG: [On the recent rebranding], we’ve worked with an agency who did the whole rebrand for Brooklyn beer. That was a really successful rebrand. They worked for us and we’re really happy. It’s taken us six to eight months to go through the whole process of it.

ET: The old cans, they are very ‘craft like’. It’s got us to where we are today, it’s fantastic and people recognise it. But 12 months ago we started on the work for the brand. We’ve got really big ambitions. We want to break into the mass market. We need a brand that matches our ambitions. We’re really excited about it. We think it’s a tipping point for the business.

I guess the main focus now is that we spent a lot of time perfecting the drinks. Now is the time for us to really focus on building the brand. Building out Hip Pop as a brand, make it instantly recognisable, so people look at the cans and instantaneously understand what Hip Pop is, what we stand for and what they’re going to get when they have a Hip Pop. That’s our focus, moving away from being a functional drink creator to a ‘big ass brand’.

JD: What do you see as the main growth opportunities for Hip Pop in the near term?

ET: We are focusing on the UK but definitely taking the opportunities elsewhere as well. Foodservice and quick service retail are key areas of focus for us, we want to give customers the opportunity to meet Hip Pop at different touch points throughout the day, and to see the brand. It’s about boosting brand visibility and presence, so people really start to see Hip Hop everywhere.

KG: We launched in our first casual dining chain last year, in December, in the restaurant chain Zizzi. It’s gone way beyond what we thought it would. They’re adding SKUs now and they are really happy with the performance.

We see foodservice has been a big area of expansion but we are also continuing our expansion in grocery and our DTC is powering on. We’ve got a really good subscription service now and a big group of subscribers who subscribe every month and receive a box in the post every month.

ET: We want to continue to build it out in the grocery space because we have a base made up of super health-conscious consumers who know what biotic soda is or what kombucha is but we are moving now towards the everyday consumer who just wants a really tasty drink.

We have looked at the States and prebiotic soda over there is flying. Olipop just got valued at $1.8bn, and they launched in 2019, and did $500m in sales in 2024. Poppi did similar. We’ve brought on board the former CFO of Olipop. He’s called Phil Trower. He’s invested in the business as well. He’s an investor in Olipop, so we’ve have a lot to learn from him. He is helping us understand the market, even though the US market and taste profiles are different over there, we still learn a lot from it.

JD: What made you decide to outsource manufacturing?

ET: On a gross margin level, it’s more expensive than if you make it yourself but then you don’t have all the overhead associated with manufacturers, staff and facilities. We’re getting to the size of the business now where we’re scaling and, on a large scale, contract manufacturing becomes more and more viable. It also frees your team and allows them, in the operations side of the business in particular, to focus their energy elsewhere.

KG: There are two types of challenger brands, right? There’s one that manufactures themselves, which we have for five years or so now. We’ve gone through literally thousands of iterations to get that perfect product. Then there’s other brands that don’t do that, where they see something elsewhere in the world, and they go to a factory and say, can you make me this? So we’re the former. We’re the one that is just obsessed with flavour.

ET: It’s a big thing when you outsource manufacturing. You’re giving your baby away, you are giving away something that you’ve created. It’s really important to find the right partner who will look after your drink like you did. When we expand into other countries, we’ll use a similarly careful process.

JD: Approximately by how much have you scaled up production since 2023?

ET: We made 3.8m cans in 2024. We tripled our business last year and our target is to repeat that this year.

KG: We are looking at 10m cans in 2025.

JD: How do you choose your price point to stay competitive?

ET: We need to be competitive in the market because if your product is more expensive than the rest of the category, competitors will cause you problems. We are constantly checking the market to see where we fit in. In terms of the single cans in grocery, £1.95 is our typical RRP. The CBD variation is a little bit over that. Our four packs are in the range of £5.25 – £6.50, depending if it’s CBD or not.

Like a lot of consumer brands right now, you’re dealing with additional costs this year. We’re constantly trying to balance those and, in the US, we are a bit more expensive. The sodas are between $2.50 and $3.50 out there.

And some brands are in 250mls cans. We’re in 330mls because we want to offer value to the customer and match against other brands.