Younger generations and male buyers are the biggest consumers of functional drinks, including sports performance, energy and smart drinks, data shows.

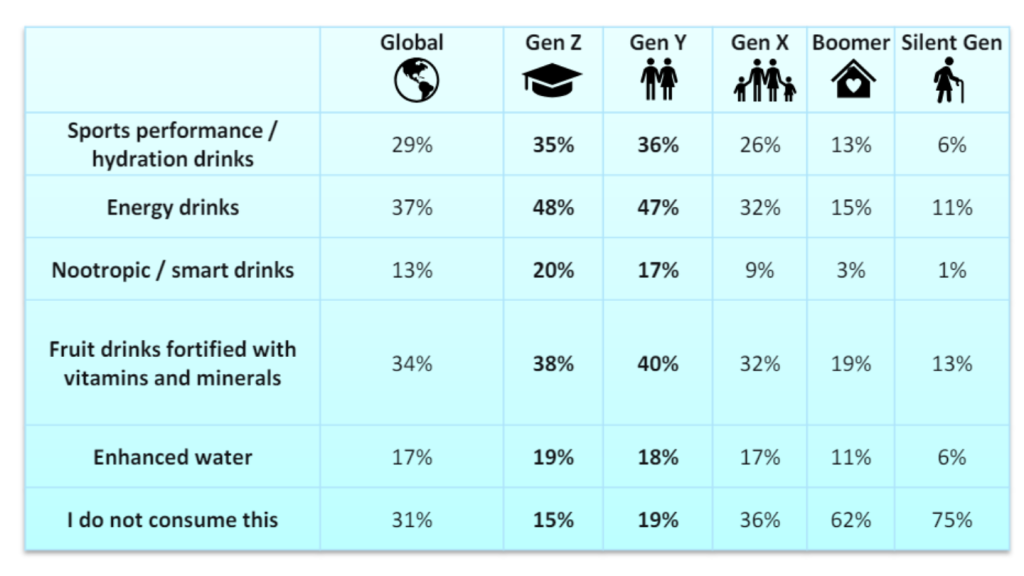

Across all consumer groups, Gen Z and Millennials have the highest shares of individuals consuming functional drinks, according to analysis by GlobalData, Just Drinks’ parent company.

The UK group has forecast a total market value of $190.24bn in 2028 for functional drinks.

Around 48% of Gen Z consumers asked in a survey said they consume energy drinks, proving to be the most popular variety of functional beverage among the younger age group. Meanwhile, only 15% of the Boomer generation said they consumed energy drinks.

Fruit drinks fortified with minerals and vitamins and sports performance drinks come in next as the most popular among younger consumers, with 38% and 35% of Gen Z consuming them respectively.

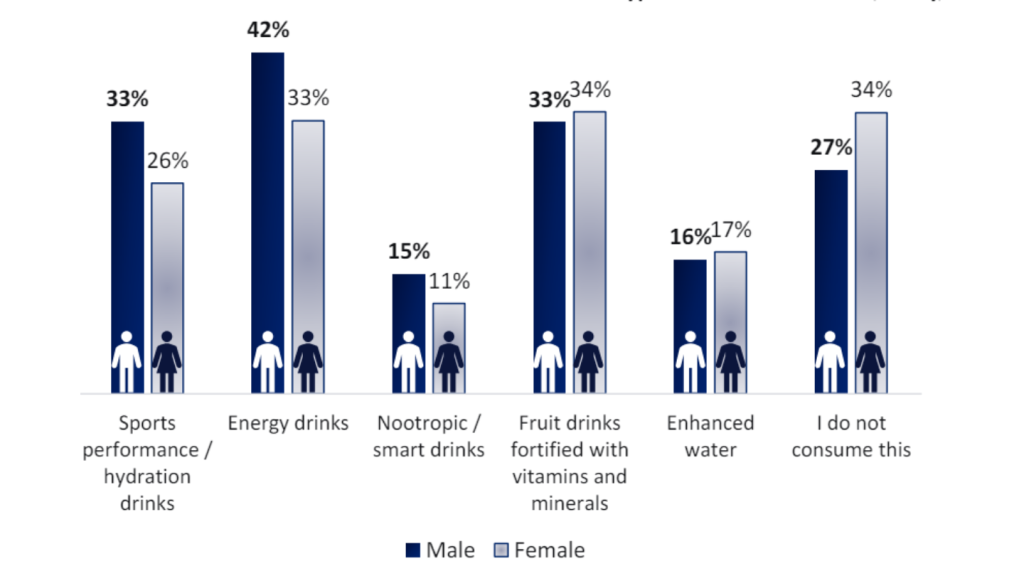

Among the global audience, a higher share of male versus female shoppers consume these products as well. For example, 42% of male consumers drink energy drinks compared to 33% of females.

Similarly, for sports performance drinks, 33% of males consume them compared to 26% of females.

However, female consumers drink more fruit drinks fortified with vitamins and minerals and enhanced water than male consumers.

Approximately 34% of female consumers said they do not consume functional drinks at all, compared to 27% of males.

Europeans, North Americans prefer black coffee

Elsewhere in the study, it emerged that only in Europe and North America is there a preference for coffee without milk.

In a survey conducted in the opening quarter of 2024, 39% of Europeans questioned said they consume espresso-style coffee, ahead of cappuccinos, lattes and flat whites.

Meanwhile, in North America, black americanos were a clear favourite with 38% of consumers drinking it.

However, Central and South Americans tend to opt for lattes or flat whites with a 53% rate, similar to Asia and Australasia with a 46% rate.

Some 51% of consumers in the Middle East and Africa favour cappuccinos with espresso coming in at 42%.

The report added: “While in the majority of global regions some coffee flavours appeal to approximately 40–50% of consumers, in Europe the most attractive coffee variation is chocolate flavour, which only one-third of Europeans find appealing.

“Therefore, brands will need to carefully tailor their new product launches, depending on the unique local preferences.”