Demand in the key western European markets will be “instrumental” in fuelling the global wine sector’s volume growth, new data shows.

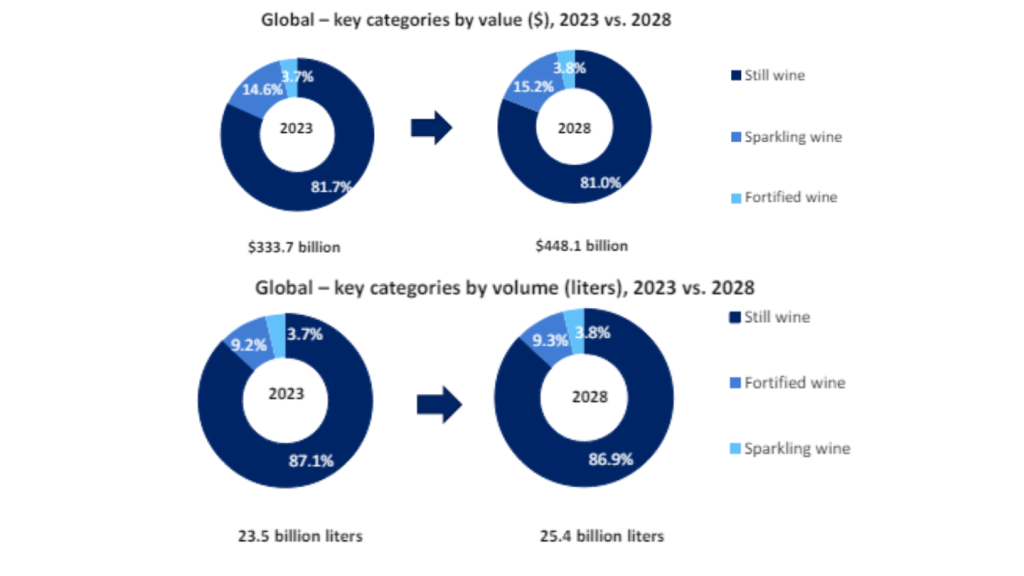

According to a report from Just Drinks’ parent group GlobalData, the global wine sector will increase in value at a CAGR of 6.1% between 2023 and 2028, reaching $448bn.

However, sales volume will grow at a slower CAGR of 1.5% during the same period, amounting to 254 million hectolitres.

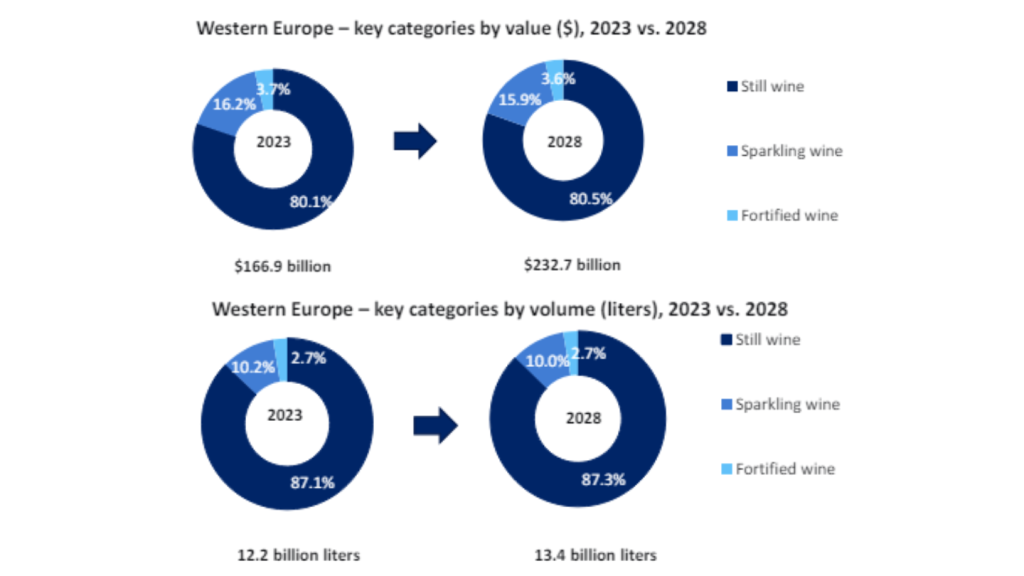

The UK and Italy, combined with France and Germany, are among the largest wine consumers in the world, amassing a volume share of 36.8% in 2023, the data shows.

The report showed the UK will register a volume CAGR of 4.7% from 2023 to 2028, amounting to circa 180 hectolitres in 2028. Meanwhile, Italy will post a volume CAGR of 2.7% during the same period.

In western Europe, which accounted for 51.9% of the total sector’s volume in 2023, sales value is set to jump from $167bn in 2023 to $233bn in 2028, while sales volume will jump 12 million hectolitres to 134 million hectolitres.

The report attributed “the easing of inflation and wage growth” to consumers being willing to spend more on wine.

It said: “The UK and France will play prominent roles in fuelling the sector’s volume growth during 2023 to 2028. Warmer weather in higher latitude countries will create more favourable conditions for wine production.

“The UK will make a significant contribution to the wine and compensate for losses in Spain, where severe drought conditions will hamper production.”

However, there are considerable threats to the global wine sector which are forecast to hinder its growth in value and volume.

“Higher-than-usual temperatures, droughts and acute water scarcity have been hampering grape yields in traditional grape-producing regions”, the report wrote. “Spain and Chile registered considerable declines in their grape yields in 2023; severe summer temperatures and droughts hindered grape harvests in Spain.

“Meanwhile, wildfires were instrumental in bringing Chile’s grape harvests down. In addition, climate change has been creating extreme weather swings, exacerbating troubles for wine farmers. For instance, Germany experienced a sudden drop in night temperatures in the second half of April 2024 after high temperatures in the first half.”

The value share of the global wine sector is set to decline between 2018 and 2028, when compared to beer, cider and spirits.

In the Americas, wine’s value share stood at 16.2% in 2018 but is set to fall to 12.1% by 2028. In western Europe, the figure will drop from 36.7% to 36.2% while in Asia-Pacific, the value share will drop 1.9% to 8.7% in 2028.

The report attributed some of these struggles to a shift in mindset for the global consumer as a result of a rise in health awareness in recent years.

“With a large percentage of global consumers concerned about their health, the demand for wines with low/no-alcohol claims will grow,” the report said.

“According to a recent GlobalData survey, 45% of global consumers are extremely or quite concerned about their physical fitness and health. Discerning consumers will stop consuming alcoholic beverages altogether if there are no high-quality low/zero alcohol options available. It will become difficult for producers to offer wines with a low alcohol content and match the quality of a regular wine.”