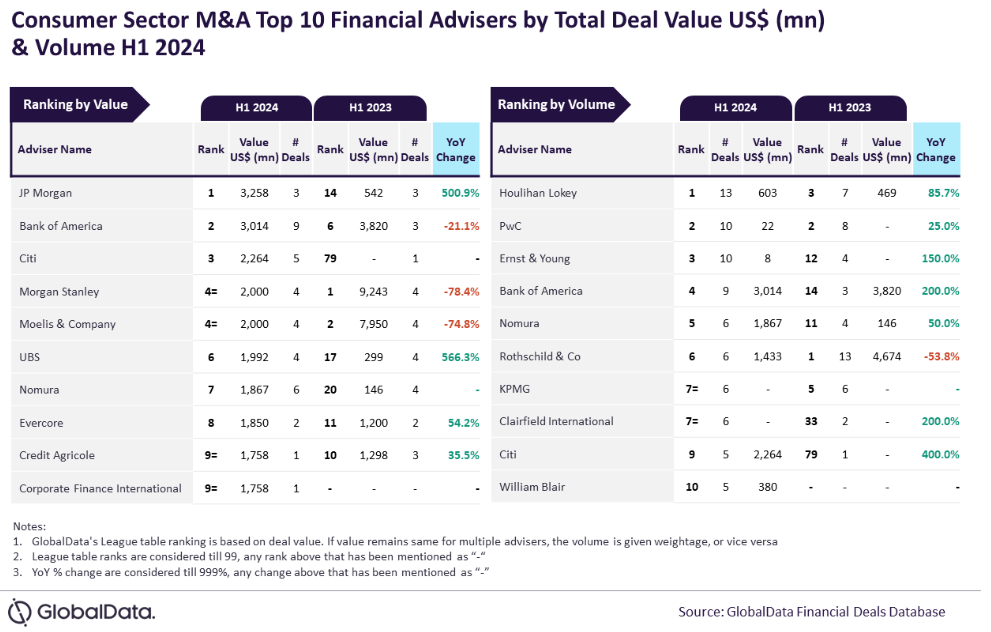

JP Morgan and Houlihan Lokey were the top M&A financial advisers in the consumer sector in the first half of the year, analysis of deal data suggests.

According to the deals database of GlobalData, Just Drinks’ parent, JP Morgan headed the charts when measuring the value of transactions, while Houlihan Lokey advised on the most deals.

Aurojyoti Bose, lead analyst at GlobalData, said: “Both JP Morgan and Houlihan Lokey registered improvement in terms of value and volume ranking by the respective metrics in H1 2024 compared to H1 2023.

“JP Morgan’s ranking by value took a big jump from 14th position in H1 2023 to the top spot in H1 2023. This can be attributed to the fact that the average size of deals advised by JP Morgan, which was just $180.7m in H1 2023, stood much higher at $1.1bn in H1 2024. Meanwhile, Houlihan Lokey was able to improve its ranking by volume from third position in H1 2023 to the top position in H1 2024.”

When looking at the value of consumer M&A, Bank of America occupied second position, advising on $3.01bn worth of transactions. Citi, Morgan Stanley and Moelis & Co. rounded out a top four that saw the latter two banks occupy joint fourth.

Looking at the number of deals, PwC was second, followed by EY and Bank of America.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.