Alongside our daily news coverage, features and interviews, the Just Drinks news team sifts through the week’s most intriguing data sets to bring you a round-up of the week in numbers.

This week, we dug into PepsiCo’s Q3 results in North America, took a look at consumer spending habits amid the high global cost of living, delved into the prospects for the global Cognac market of the next five years and analysed the prospects for flavoured alcoholic beverages after Nolet’s move to buy Lucas Bols.

PepsiCo drinks boost giant’s profits in the US and Canada despite volume drop

PepsiCo Beverages North America (PBNA) saw revenue rise 8% to $7.16bn in the third quarter of 2023, while operating profits rose to $970m for the three-month period.

Volumes for the North America beverage business fell 6%, however, which CEO Ramon Laguarta attributed to a “more aggressive” strategy towards volume optimisation.

“We’ve made some decisions, especially around take-home water, [so] that we’re able to prune some promotions that were not profitable for the business, and that has had almost 2.5 points of volume impact. So that’s how we’re managing volume,” he said.

The continent’s performance compares to group net revenue which rose 8.9% year-on-year to $23.45bn in Q3, while operating profit jumped to $4.02bn. Revenue in Latin America was up 21% to $3.05bn. Europe, on the other hand, rose by only 2% to $3.7bn.

It comes as the group this week tackled the controversial issue of weight-loss drug GLP-1 during its third-quarter results call with analysts.

Laguarta described the impact of the appetite-suppressing drug as “negligible” to PepsiCo’s business. However, he said it had a “sound strategy” for “portfolio transformation” if necessary.

Grocery-conscious spenders cut back on alcohol

Over half of those cutting back on their grocery spend in the last three months have stopped buying alcohol altogether, according to a survey of 21,555 people worldwide.

Of the total, 28% – 5,951 people – said they had cut back grocery spending to make savings compared to three months ago, according to the analysis by GlobalData, Just Drinks’ parent company.

Of those, 58% – 856 people – said they had stopped buying alcoholic beverages altogether to consume at home because they were too expensive. A further 33% had traded down in the alcohol they bought, either by buying private label and cheaper brands, trading down within their usual brand’s range, or swapping to a cheaper supermarket.

Only 9% of people had stuck with the brands they previously bought and were cutting down on quantities or regularity of purchases.

For non-alcoholic beverages, meanwhile, fewer people had cut back altogether but more had traded down. Around 36% of people traded down to a private-label soft drinks brand or other cheaper brands over the ones they bought three months ago.

The full survey can be found on GlobalData’s Intelligence Centre.

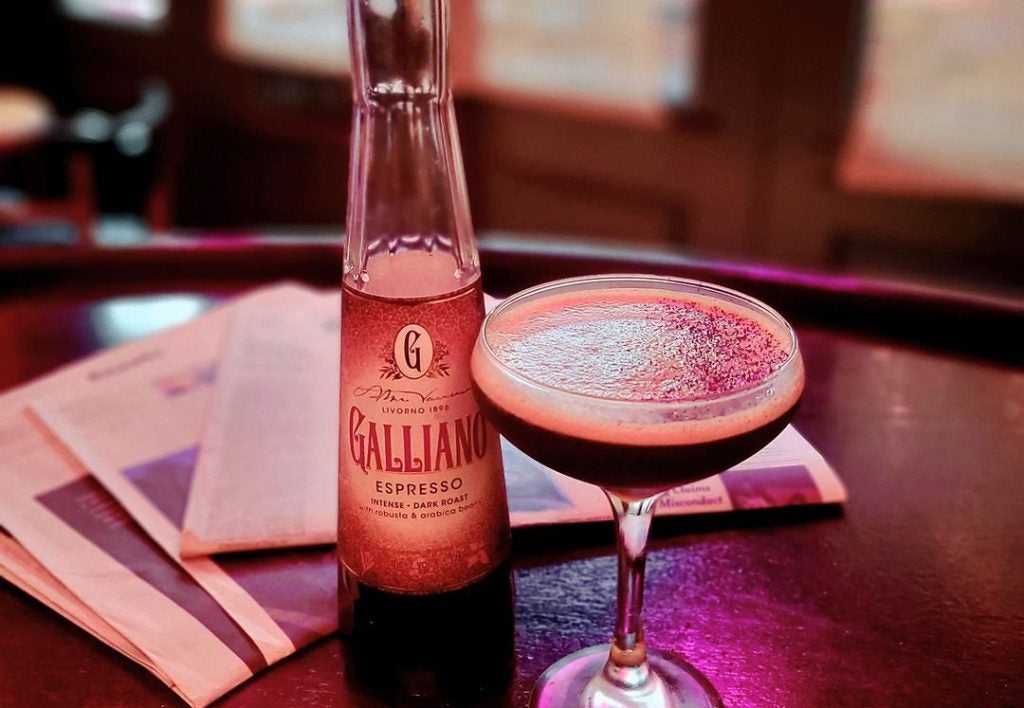

Flavoured alcoholic beverage sales to increase by fifth by 2027

Global sales of flavoured alcoholic beverages are set to increase from 9.7bn litres a year to $12.1bn by 2027, according to predictions from analysts at GlobalData.

The company’s definition of flavoured alcoholic beverages includes alcoholic soft drinks, hard seltzers, pre-mixed spirits and wine coolers.

It comes as this week Ketel One maker Nolet made a move to buy Lucas Bols. An offer valuing the liqueurs and Tequila business at €269.5m ($284.1m) was backed by Lucas Bols’s management and supervisory boards.

Family-owned Nolet has been a shareholder in Lucas Bols since the cocktail maker listed in 2015. It owns 29.9% of the business.

Speaking to Just Drinks yesterday David Harris, alcoholic beverages research director at GlobalData, said: “Lucas Bols is gaining a partner with financial power which could open doors to growth that it would be unable to open alone.”

He added: “Furthermore, Nolet has a track record of developing brands as seen with Ketel One. Bols, while popular, has never managed a mainstream breakout moment and this possibility may have factored into the deal.”

Global Cognac market rebounds following pandemic slump

The value of the global Cognac market is set to grow slowly over the next five years, according to analysis by GlobalData.

Worth $15.7bn in 2022, it is set to reach $21.6bn by 2027 if predictions are correct. It follows a dip to $12.6bn in 2020, surpassing pre-pandemic levels again by 2022.

It comes as this week US whiskey producer Uncle Nearest revealed it had acquired French wine estate Domaine Saint Martin and plans to produce Cognac.

Uncle Nearest has hired former vice president of global marketing for Bacardi’s Patrón Tequila brand, Adrian Parker, as president of its Cognac venture, which will not share the same brand name.

Founder and CEO Fawn Weaver said the Cognac brand would pivot “from the norm”, noting it would create a short film with viewings at film festivals before launching.

Grocery inflation falls below headline US rate but soft drinks higher

The cost of groceries fell below the headline inflation rate for the second month in a row in September, government analysis shows.

The US Bureau of Labor Statistics’ measure for the food-at-home category (including grocery store or supermarket food purchases) climbed 2.4% in the 12 months through September, compared to 3% in August. The cost of non-alcoholic beverages, however, was up above the food-at-home average, at 4%.

The all-items headline measure of inflation held at 3.7%, leaving markets guessing whether the Federal Reserve will pause in its tightening cycle that has left people paying more for mortgages.

The US central bank has a target of getting annual inflation down to 2%, although the month-on-month rise in prices slowed to 0.4% from 0.6%.