Alongside our daily news coverage, features and interviews, the Just Drinks news team sifts through the week’s most intriguing data sets to bring you a roundup of the week in numbers.

This week, we took a look at expectations for the UK non-alcoholic beer market as the government announced a labelling review, inspected the prospects for energy drinks in India as Tata Consumer Products launches a range there and eyed China's preference for bottled water in the soft-drinks category.

“Alcohol-free” beer set to maintain boom

The UK alcohol-free beer market is set to continue its strong growth trajectory over the next five years, according to research from GlobalData, Just Drinks’ parent.

Both the 0.0% abv and 0.0 – 0.5% segments are set to boom – with the former anticipated to reach a market value of $460m by 2027 with a CAGR of 16.86%, compared to $150m in 2022 with a CAGR of 52.6%.

For those beers containing up to 0.5% abv, the market is expected to grow from a lower base of $120m in 2022 to $220m by 2027 – a slower pace of growth than the 0.0% abv category but still reaching just under 200% category growth.

It comes as the UK government this week announced a public consultation to review the threshold for labelling a beverage as “alcohol-free”.

The consultation will call for feedback on a proposal to raise the threshold for an “alcohol-free” drink to an abv of 0.5%, hoping to make alternatives to alcoholic drinks more widely available and popular.

This would bring it in line with the likes of the US, Denmark, Germany, Australia, Sweden, Portugal and Belgium.

Currently, “alcohol-free” drinks in the UK must have an abv of 0.05% or less. Meanwhile, “low-alcohol” refers to any product with 1.2% abv or below.

Energy drinks to continue fizzing in India

India's energy-drinks market can expect plenty of growth over the next five years, analysis suggests.

GlobalData forecasts energy drinks sales in India will hit $2.63bn in 2023. If sales do reach that level, that would represent a five-year CAGR of almost 69%.

The category is expected to soar to $12.8bn by 2027, with a CAGR of 51.3%.

It comes as FMCG giant Tata Consumer Products entered India’s energy drink market this week with the launch of its own brand: Say Never Energy Drink.

Two variants will go on sale for Rs10 ($0.12) in a 200ml format, initially at retail outlets in the state of Karnataka and in unspecified markets in northern India.

Vikram Grover, managing director of Tata subsidiary NourishCo Beverages, said: “This affordable caffeine-based energy drink is for the young masses and, with this, we are here to fuel their journey.”

France’s Scotch consumption second in world for value and volume

France was the world’s largest importer of Scotch whisky before it was overtaken by India last year, knocking it into second position. However, both markets remained head and shoulders above the US, the third largest importer by volume.

In 2022, India imported 219m 70cl bottles compared to 205m 70cl bottles in France, according to data from the Scotch Whisky Association.

France was the spirit’s top exporter by volume in 2021, but consumption declined 0.1% to 176m bottles, whereas India grew 44.3% to 136m bottles.

Value-wise, the US remains in pole position. In 2021, it exported £790m worth of Scotch, which rose 33% to £1.1bn in 2022. France remains in second place in terms of value. The value of exports rose last year, from £387m in 2021 to £488m in 2022.

This week French spirits major La Martiniquaise-Bardinet cited France’s thirst for Scotch as part of its growth strategy on Cutty Sark.

The brand, which this week celebrated its 100th anniversary in London, has a “limited” presence in France but the group said it is determined to “regain” the market.

Bardinet global marketing manager Laure Habbouse said: “We want to regain France. Cutty Sark was quite popular back in the 1980s and 1990s in France and today it’s like a new launch almost, because the younger generation doesn’t know Cutty Sark. So that will be a focus for us for sure.”

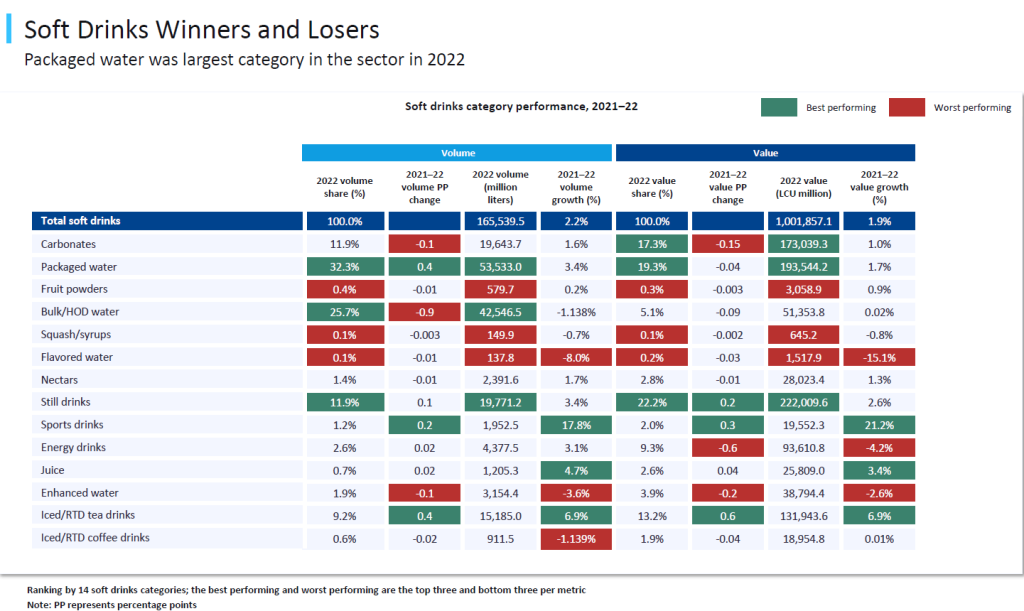

Bottled water sinks soft-drinks competition in China

The overall soft-drinks market in China grew 2.2% in volume to 165.5bn litres in 2022, compared to 2021, and grew 1.9% in value to 1trn yuan ($137bn).

However, the water category stole the limelight – with packaged water taking a 32.3% market share (up 0.4% on 2021) in volume and a 19.3% market share in value (down 0.04%). The packaged-water market was worth 193.5bn yuan in 2022.

Bulk water holds nearly a quarter of the soft-drinks market in volume. However, it dipped slightly in both volume and value last year.

It comes as this week Coca-Cola bottler Swire Coca-Cola announced it was aiming to have three more plants up and running in 2025.

Swire, owned by Hong Kong-based conglomerate Swire Pacific which has 25 plants in mainland China, has started building a factory in Suzhou in eastern China and wants to set up plants further north in Zhengzhou and in the southern city of Guangdong.

The group described the project in Suzhou as the “single largest strategic investment in the Chinese mainland market”. Around 2bn yuan ($274.5m) is being spent on the new factory.

Shoppers to remain beady-eyed on shrinkflation

Social media mentions of "shrinkflation" will remain high in 2023 (year-end projection) but will begin declining from its 2022 high, according to GlobalData's analytics database. Searches for the term, which refers to the downsizing of a product while the price remains the same or increases, were almost non-existent in 2019 but soared to 570 in 2022.

It comes as this week French President Emmanuel Macron said the government was preparing a bill to force manufacturers and retailers into early price negotiations in an attempt to slow grocery price inflation.

Meanwhile, Bruno Le Maire told France Info he intended to present a new law at the beginning of October to tackle shrinkflation. The measure would force manufacturers from November to disclose weight reductions on food labels when they retain the same packaging.

Intermarché and Carrefour have already publicly called out manufacturers for the practice, naming and shaming food giants such as PepsiCo, Unilever, Doritos and Findus. Shrinkflation, Carrefour CEO Alexandre Bompard said, represented “the height of cynicism”.