Alongside our daily news coverage, features and interviews, the Just Drinks news team sifts through the week’s most intriguing data sets to bring you a roundup of the week in numbers.

This week, we took a look at the enduring fall of Bud Light's US sales, analysed Carlsberg's falling volumes as the brewer reported its third-quarter results, eyed FMCG giants' progress on packaging as the Ellen MacArthur Foundation released its Global Commitment report and looked ahead at Pakistan's thirst for soft drinks.

Bud Light row’s enduring impact

The fallout from Bud Light’s disastrous partnership with Dylan Mulvaney row has compounded pressure on Anheuser-Busch InBev’s US sales, it revealed this week.

The beer giant’s sales to wholesalers and retailers in the US were down even before the Dylan Mulvaney controversy, according to its third-quarter financial results.

But speaking to analysts this week, CEO Michel Doukeris said the beer giant was “moving in the right direction” as “lapsed” Bud Light drinkers become “more open” to returning to the brand.

In the three months to the end of September, AB InBev’s volumes in North America fell by 17.1% on an organic basis. The consensus forecast among analysts was for a drop of 14.3%. Third-quarter revenue was down 12.7% organically at $3.86bn versus the consensus forecast of a 10% decline.

In the US specifically, AB InBev’s third-quarter revenue declined 13.5%, although the Budweiser owner said revenue per hectolitre was up 4.9% “driven by revenue management initiatives”.

The company said the third-quarter decreases were “primarily” due to lower Bud Light volumes and “shipment phasing ahead of our October price increase last year”.

The brewer said its market share in the US had been “stable” since the Mulvaney debacle in late April.

Less drink Carlsberg in Q3

Carlsberg reported another quarter of lower volumes on an organic basis in Q3, as the brewer remains wary about consumer sentiment in Europe and South-East Asia.

Organic volumes fell 3% (they dipped 0.6% over the first nine months of the year as a whole). Volumes dropped in western, central and eastern Europe, but rose in Asia, leading to optimism in China.

The Tuborg maker is still predicting a 4-7% rise in operating profit this year after booking a 5.8% increase in third-quarter revenue on an organic basis. Revenue per hectolitre was up 9%, with Carlsberg pointing to “strong growth” in parts of Europe. Reported revenue grew by 0.3% to DKr20.3bn ($2.88bn).

Speaking to analysts this week after Carlsberg published its Q3 trading update, CFO Ulrica Fearn said: “Looking at the trading environment across our markets, consumer sentiment in Europe is weak and that may pose a risk for our volumes, channel and brand mix.”

Packaging progress or PR exercise?

FMCG company filings' mentions of "sustainable packaging" continue to increase, according to analysis from GlobalData, Just Drinks’ parent company.

GlobalData's analytics, which track 22,878 consumer goods companies, show that mentions of "sustainable packaging" in FMCG company filings have increased more than tenfold between 2016 and 2022.

But many beverage companies remain woefully behind on their 2025 sustainable plastic use targets, leading to the Ellen MacArthur Foundation to warn “the global community is still way off course in the pursuit of eradicating plastic waste and pollution”.

This week, the foundation’s Global Commitment progress report was released, revealing holes in several FMCG giants’ progress.

Notable laggards include Mars, which increased its use of virgin plastic by 14% in 2022 compared to 2019, and PepsiCo, which used 10% more in 2022 compared to 2020. Beverage giant The Coca-Cola Company used 8% more virgin plastic packaging in 2022 compared to 2019.

La Marca Prosecco tops luxury wine brands in US retail

La Marca Prosecco tops its peers in terms of category MULO+C (multi-outlet with convenience stores) share in the US, data shows.

The Italian sparkling wine came top compared to others in the $15 plus range per bottle within $40m plus brands, according to data compiled by Treasury Wine Estates from Circana Market Advantage.

It comes as this week Treasury Wine Estates announced its plan to acquire US ‘luxury’ wine brand Daou Vineyards and set up a luxury division within its Americas portfolio.

The Melbourne-headquartered group said Daou was underrepresented outside of California, where it has “an excellent distribution footprint”. In the US, which accounts for 86% of sales, the brand is split 70-30 off-premise versus on-premise.

Treasury Americas said: “Within US trade, Daou has a significant opportunity for distribution growth, with current weighted distribution below that of key luxury peers.”

The group plans to use its “deeper luxury distribution footprint across the US” to boost the brand’s growth, and also plans to grow its on-premise presence.

Quenching Pakistan's thirst for soft drinks

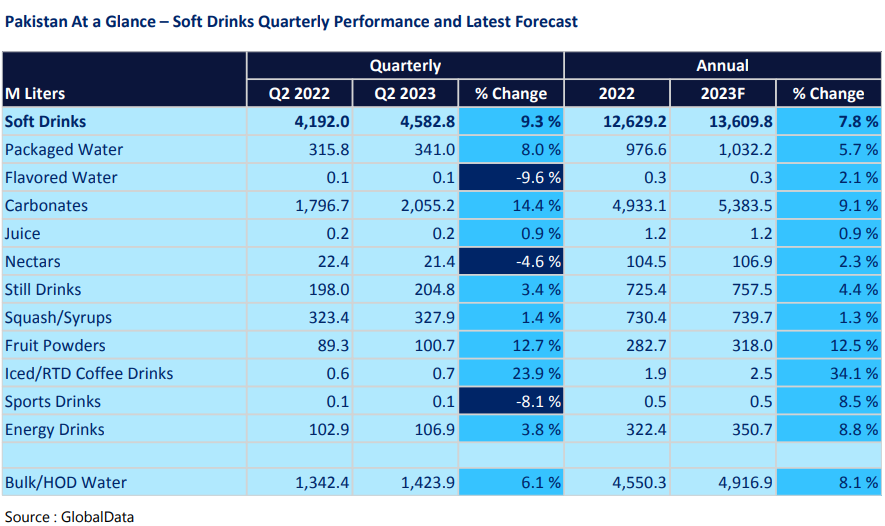

Pakistan’s soft-drinks market is forecast to see overall volumes grow almost 8% in 2023, according to GlobalData analysis.

In its ‘Pakistan Quarterly Beverage Forecast Data Book 2nd Quarter 2023’, GlobalData predicted the largest growth could be seen in the iced and ready-to-drink (RTD) coffee drinks segment, with a 34.1% rise expected in 2023 compared to 2022.

Overall, the soft-drinks market is set to grow 7.8% in 2023 to 13.6bn litres.

It comes as this week Coke bottler Coca-Cola Icecek secured competition approval in Pakistan for its acquisition of The Coca-Cola Co.’s stake in its local subsidiary.

The Competition Commission of Pakistan gave the green light to Coca-Cola Icecek’s move to buy 49.67% of Coca-Cola (Pakistan) for $300m.

Citing figures from GlobalData, the group said Pakistan’s per-capita consumption of non-alcoholic RTD beverages stands at 126 eight-ounce servings a year. By contrast, that figure in Kazakhstan – another of Coca-Cola Icecek’s markets – is 675 and is 1,447 in the US. GlobalData includes sparkling drinks, juices, bottled water, RTD teas and energy drinks in its calculations.