Anheuser-Busch InBev’s Camden Town Brewery Stout

- Category – beer, stout

- ABV – 4%

- Location – UK

- Price – Not immediately available

Camden Town Brewery announced the launch of its latest beer: Camden Stout. The AB InBev owned brand has created the beer to sit alongside its flagship Hells and Pale Ale. The beer will be available exclusively in the on-premise channel.

Just Drinks thinks: Camden stole the march on craft lager with the introduction of its iconic flagship Hells brand in 2010 and the success of the line was a major factor in Anheuser Busch InBev shelling out £85m ($105.8m) to acquire the London brand outright in 2015. The now Enfield-based brewer won’t have the same advantage with its latest product, which has doubtless been made with one envious eye on the success enjoyed by Diageo’s Guinness in the UK on-premise in recent times.

This is not the first time Camden has tried its hand at stout, and it’s also far from the first craft brewer to try and take on the might of Guinness (BrewDog has been typically brash in the marketing push for its own attempt). Will it work? We’re not so sure. The appeal of Guinness has been solidified by decades of canny marketing, leading to a cult-like following. Combine this with the strangle-like hold the brand has on taps across the UK on-premise and it’s hard to see where Camden can make inroads. Smaller craft breweries can and have picked up taps by offering an ‘independent’ alternative pint of the black stuff, but the AB InBev-owned brand doesn’t even have this in its favour. Camden Town is known for its consistently excellent lager and that’s probably what it ought to stick to.

Bacardi Mango Chile

- Category – spirits, rum

- ABV – 35%

- Location – US

- Price – $12.99 per 75cl bottle

Bacardi has unveiled its latest flavoured rum – Bacardi Mango Chile. The SKU is made from Bacardi’s classic white rum, blended with “natural mango extracts” and “bold chili spice”, according to the privately-owned spirits company.

Just Drinks thinks: Mexico’s enduring cultural influence over the US continues to show in both the popularity of Tequila, and in the spillover Mexican wave (sorry) this has created in other spirits categories. Brands desperate to ride the coattails of agave but, without the means to do so, are inventing all manner of cocktails that use their own spirit instead (I mean, what on earth is a ‘Rum Rita’!?).

This latest extension from Bacardi goes further still, infusing the brand’s white rum with the flavours of the popular Mexican snack. Bacardi Mango Chile is designed to be drunk “an easy-to-drink chilled shot” according to the brand, garnished with a Tajín Clásico Seasoning rim (wonder where they got that idea from?). All in all, it’s an inoffensive, albeit not massively original, concept, that’ll likely play well with experimental, younger, LDA drinkers, given its low price point.

Canarchy’s Oscar Blues Brewery Dale’s American Light Lager

- Category – beer, lager

- ABV – 4.2%

- Location – United States

- Price –$14 per 15-pack of 12oz (340ml) cans

Monster Beverage Corp.-owned Canarchy has extended its Oscar Blues Brewery Dale’s brand into American light lager and double IPA with two new extensions. A mixed 15-pack featuring all three Dale’s beers will be available, alongside multi-packs of each SKU. The expanded Dale’s line-up has also undergone a brand refresh.

Just Drinks thinks: One of the more intriguing trends to have arisen in the US over the last twelve months has been the resurgence of light beer, a category that seemed dead in the water just a few years ago (when even Bud Light is pivoting to seltzer, you know it’s not a good sign for the segment’s health). Whether it’s down to pressure on consumer spending or drinkers tiring of the hard seltzer fad, light beer continues to claw back share in the US, with nearly all the major brands (AB InBev’s current Bud Light travails aside) reporting sales are on the up.

In this context, Canarchy's decision to extend the Dale’s brand into the segment is an interesting move. Dale’s Pale Ale, which makes up 45% of Oscar Blues’ sales, was one of the original pioneering US craft beers, and trying to capture drinkers that have tired of hard seltzer but still want a low-calorie option could prove a masterstroke. The refreshed branding is gorgeous and plays on Dale’s status as a now heritage US beer brand, whilst the double IPA extension shows Monster is still keen to speak to Oscar Blues’ hardcore craft drinkers. This looks like a smart bit of innovation.

Campari’s Appleton Estate 17 Year Old Legend

- Category – spirits, rum

- ABV – 49%

- Location – 18 countries including the US, Japan, the UK, Jamaica, France and Benelux

- Price – £500 per 70cl bottle

Appleton Estate, the Campari-owned rum brand, has launched a limited-edition 17-year-old expression. The 17 Year Old Legend, of which just 1,500 bottles will be available, is inspired by the rum distilled by J. Wray & Nephew on the Estate in the 1940s.

Just Drinks thinks: At a polar end of the price-point spectrum to Bacardi’s Mango Chile innovation is this extremely limited rum from Appleton Estate, which pays homage to the origins of the Mai Tai cocktail.

The Campari-owned Appleton Estate has created what it claims is a faithful recreation of J. Wray & Nephew’s 17-year-old blend. One shudders to think of the amount of liquid lost during the product’s long maturation in Jamaica’s tropical climate, and this is reflected in the 17 Year Old Legend’s £500 price tag.

Speaking to Just Drinks after Diageo’s acquisition of Don Papa earlier this year, Jefferies’ Ed Mundy said he saw “reasons for optimism for the rum category, in particular in the high-end, dark variants.” The fact Campari believes there is a market for this level of premium expression, especially one that isn’t even designed to be drunk as a sipping variant, is an indication of the direction in which the category is headed.

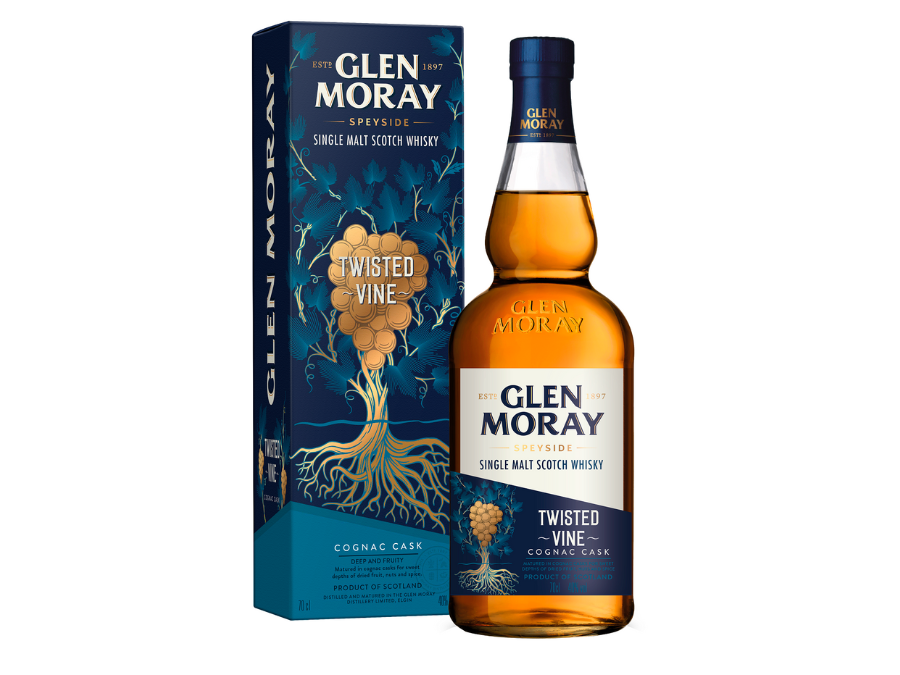

La Martiniquaise’s Glen Moray Twisted Vine

- Category – spirits, whisky

- ABV – 40%

- Location –UK

- Price – £28 per 70cl bottle

Speyside Scotch whisky distillery Glen Moray has introduced a single malt whisky matured on ex-Cognac casks. Twisted Vine will sit alongside core Glen Moray expressions including its Classic Port Cask Finish and Peated Single Malt.

Just Drinks thinks: Having previously released (via its Elgin Curiosity range) both cider and agricole rum cask-finished expressions, the launch of Twisted Vine shouldn’t come as a surprise given Glen Moray’s penchant for experimentation. In fact, what’s more unusual is that this experiment by the Speyside distiller has taken as long as it has to come to fruition.

The price point compared to other Cognac-matured whiskies is pretty competitive (presumably a reflection of the lack of age statement on the line) and this, along with the brand’s partnering with leading mixologists at UK on-premise venues to launch the product, suggests Twisted Vine will be more of a mixing than a sipping whisky.

Nonetheless, this seems it’ll make an interesting and accessible entry point for novice single malt explorers looking to expand their horizons.

Bisleri International Pop, Rev and Spyci Jeera CSDs

- Category – soft drinks

- ABV – N/A

- Location – India

- Price – Not immediately available

Bisleri International, the Indian packaged water and soft drinks giant, has launched three new CSDs in its domestic market. The trio of new flavours – Pop, Rev and Spyci Jeera – join Bisleri’s flagship Limonata and have been created to resonate with a Gen Z audience.

Just Drinks thinks: Indian soft drinks continues to be a category we watch at Just Drinks with a keen eye. The recent relaunch of Campa Cola set industry watchers’ tongues wagging and has raised the realistic prospect of competition once again in a market long-since dominated by CSD giants The Coca-Cola Co. and PepsiCo.

Enter stage right Bisleri with three new flavour extensions to add to its soft drinks range. While we weren’t able to confirm the retail price for the new Bisleri Pop, Bisleri Rev and Bisleri Spyci Jeera variants, the company’s flagship Limonata sits at a similar price to Campa Cola and significantly below that of a can of Coke and Pepsi. This will likely make the drinks popular with the 68% of Indian consumers who are extremely concerned about the impact of inflation on their household budget (according to GlobalData).

Indian consumers are also showing an increasing preference for local brands and trust the endorsements of celebrities (GlobalData’s most recent consumer survey showed 29% of Indians actively look for these when making purchasing decisions). Hence, the decision to partner with Indian actors popular on streaming platforms to promote the drinks seems like a sensible marketing strategy.