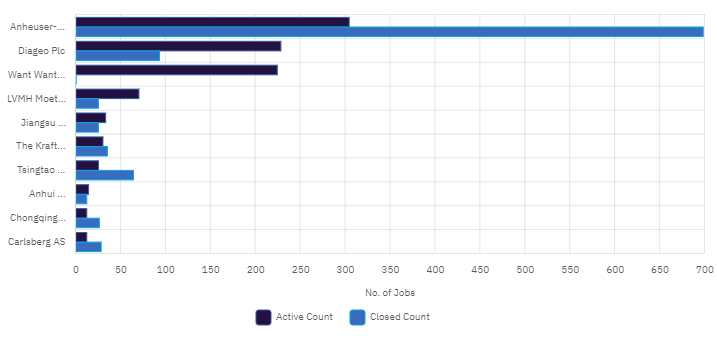

Beer giant Anheuser-Busch InBev and spirits giant Diageo topped the list of active recruiters in China’s beverage alcohol industry in the first half of 2023, data shows.

The Budweiser brewer had 304 ‘active’ roles across its operations in China during the opening half of 2023, up from 274 in the previous six months, according to analysis by GlobalData, Just Drinks’ parent. Active jobs are roles open for application.

UK-listed Diageo, which sells brands including Johnnie Walker whisky in China, had 228 open positions. That compared to 135 in the second half of 2022.

GlobalData’s Job Analytics database tracks daily job postings across multiple industries, including consumer goods. As part of the research and intelligence company’s analysis, it groups jobs by theme, providing an indication of where businesses are focusing their hiring efforts.

Overall, there were 1,007 open roles across the beverage alcohol groups operating in China monitored by GlobalData.

Looking at where the jobs were located, 131 – or 18% – were in Shanghai, followed by Sichuan (36) and Guangdong (34).

Examples of the open positions included AB InBev looking for sales reps in Ningbo and Diageo recruiting for a CRM data analyst in Shanghai.

Last week, Asahi Group Holdings said it was eyeing expansion in China, particularly in “top” cities including Shanghai and Shenzen.

Asahi’s focus in China has historically been in “Japanese channels” but the group is aiming to make waves in mainstream on- and off-premise outlets.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.