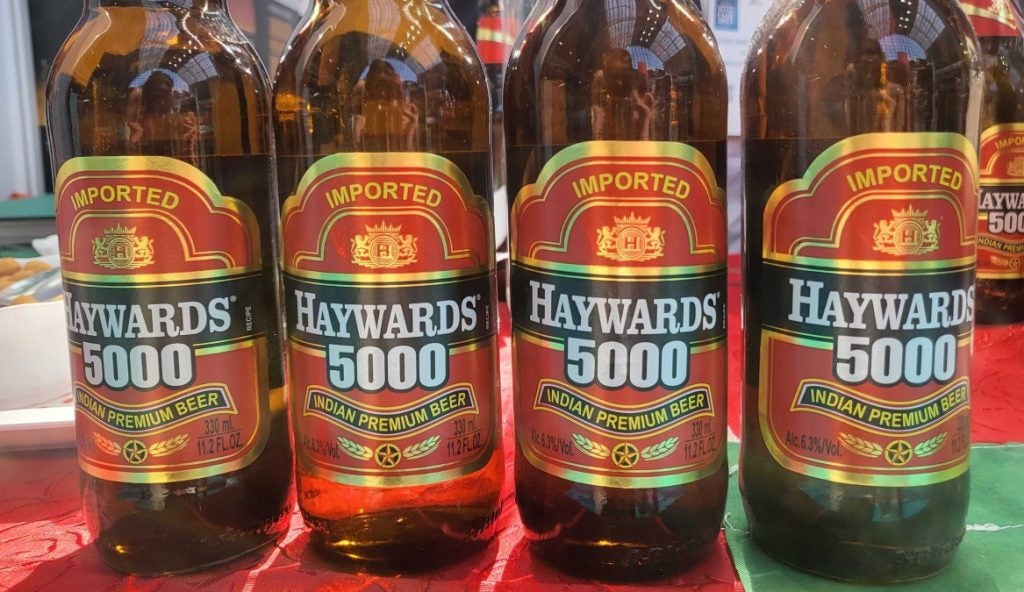

UK-based importer Trident Traders is to import AB InBev brand Haywards 5000 to Europe for the first time, it said, launching first in the UK.

The family-run wholesaler and alcohol importer, which was founded just over two years ago, said it saw a gap in the market for higher-strength Indian lagers in the UK – Haywards has an abv of 6.3%.

“It’s a lager with a little bit of extra punch,” director Sasikumar Ganesan told Just Drinks at the London Wine Fair earlier this week. “We want to expand and establish it in the UK.

“You’ll not find a lager with 6.3% abv in the UK – it’s all IPAs or stouts. This is unique,” he said.

Haywards 5000 was created in 1984 and Ganesan said it is one of the largest-selling “premium” beers in India.

The first shipment of Haywards 5000 arrived in the UK two weeks ago and the brand is already available in some restaurants in London.

Ganesan is planning to expand its presence across the country, as well as in Europe. He is already in talks with national UK supermarkets and wholesalers about stocking the brand.

Next, he is eyeing expansion in France, Denmark and Norway. Trident Traders will then look expand to the “rest of Europe”, Ganesan said.

Haywards 5000 sits under AB InBev’s ‘Indian brands’ portfolio, alongside Budweiser Magnum, Knock Out and Becks Ice. The company told Just Drinks it is not directly involved in Trident Traders’ import plans.

It comes as last week, at the International Beer Strategies Conference in Portugal, Damm international business unit director Juan Gonzalez advised drinks companies to invest in world beer lagers.

“If you have only one world beer lager in your repertoire, you're missing half of the opportunity,” he said.

He estimated this segment – which for the UK includes brands like Damm, Peroni and Moretti – forms 30% of beer sales.

Also speaking at the conference, GlobalData analyst Kevin Baker said the move towards premium products had been happening for “ten years plus” and was “ultimately a value-driven proposition”.

Global beer value sales are set to grow at a 3.9% five-year CAGR between 2023-2028, according to GlobalData, Just Drinks’ parent company. Volume sales, meanwhile, are predicted to see a slower five-year CAGR of 1.3%

In 2022, the ‘super premium’ and ‘premium’ beer categories grew 5.8% and 5.6% respectively, compared to the previous year, according to GlobalData. These two price segments formed just over a quarter of beer sales in 2022.