- Value for money set to drive Christmas spending as inflation cools

- Products with a sense of authenticity that offer a learning experience are in demand

- Subscription models such as meal kits gaining consumer interest and uptake

For many European countries, 2024 will see the first Christmas in years without high inflation or a global pandemic, though the residual impact for both is still being felt. With topline inflation at a manageable rate but with food inflation remaining at a higher level than would be desirable, data and analytics firm GlobalData, Just Drinks' parent, predicts the emergence of three key themes that will influence European consumer spending and shopping trends this Christmas.

Affordable authenticity

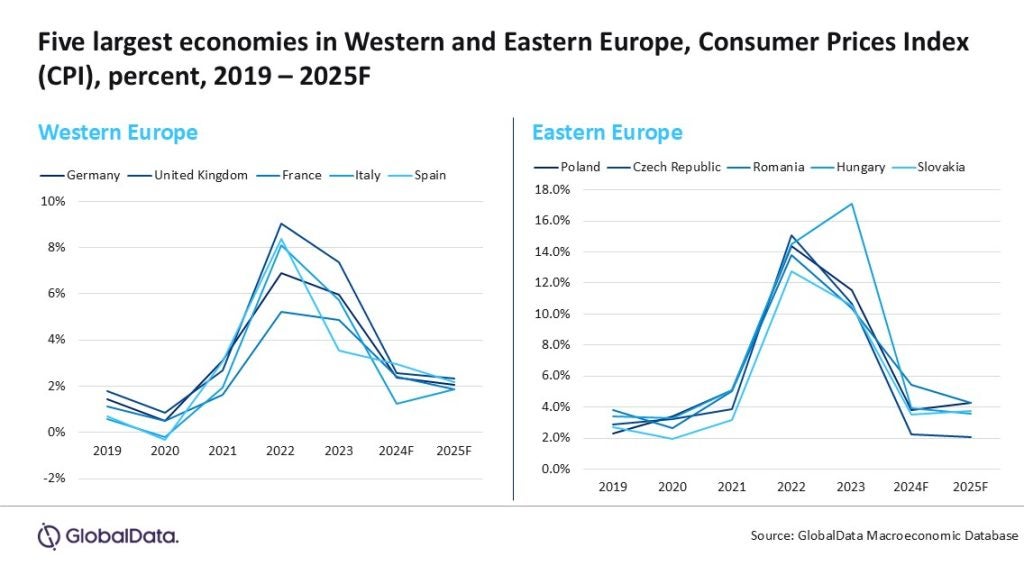

For much of Europe, 2022 saw a sharp increase in inflation and, while 2023 saw a lower inflation rate, it was still high enough to hinder a recovery in consumer spending. For example, the UK had a CPI rate of over 9.1% in 2022, 7.4% in 2023, and is forecast to see 2.6% in 2024. Other major economies in both Western and Eastern Europe followed similar trajectories.

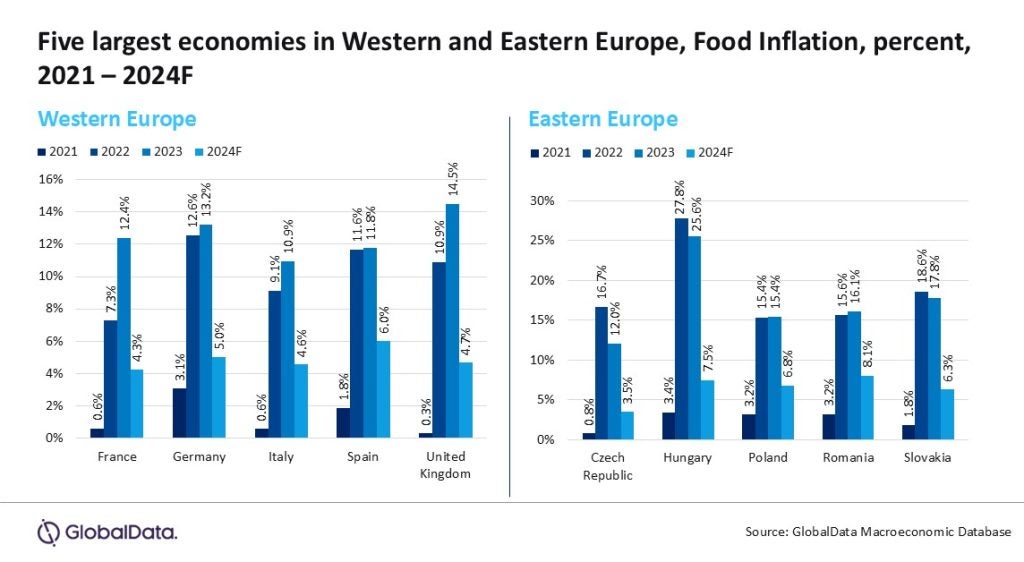

Of course, lower inflation does not equal lower prices. Even where wages have kept up with the CPI, specific categories, such as food and drinks, have outpaced general inflation. For example, while the UK and France’s 2022 CPI rates were 9.1% and 5.2% respectively, food inflation was higher, at 10.9% (the UK) and 7.3% (France).

Another issue compounding the problem has been that food inflation has not come down with overall inflation.

“Looking at 2024 specifically, it is clear that European food inflation is only correlating loosely with general inflation trends and remains high in many major economies," Fred Diamond, senior food consultant and analyst at GlobalData, says. "European consumers are contending with a market environment that is still seeing higher inflation for key categories but which also bears the scars of previous inflation. Companies tried to limit price-increases through ‘shrinkflation’ and ‘skimpflation’, with products that have gotten smaller and/or more cheaply made. Therefore, this Christmas, the concept of value for money is key.”

In light of recent price increases, 25% of European consumers report cutting back on grocery shopping, according to the latest GlobalData consumer survey results. Another GlobalData survey shows 74% of the respondents state that a brand or product’s ‘authenticity’ is ‘essential’ or ‘nice to have’ when making a purchase. Products that maintain a sense of authenticity, heritage, or tradition while offering a good-value price point, will be in high demand.

An example can be seen in the UK where, like many of its European neighbors, Christmas hampers packed with jams, chutneys, relishes, and crackers, are a seasonal tradition. Aldi has used an independent artisan chutney maker for its private-label selections, under the banner ‘Specially Selected’. During the Christmas-shopping season, the retailer sells them in boxed assortments at a low price, presenting strong competition to more established chutney and relish brands for which Christmas is an important time of the year.

Connoisseurship and food-based learning experiences

One of the more persistent trends pervading Western markets in recent years has been the idea of connoisseurship, the desire among consumers to engage with food and drinks they can learn more about and in which they can take a real interest. This has a long history in wine, coffee and chocolate, all of which have benefited from the contemporary salience of the trend. More recently, categories such as hot sauce have joined the fray.

Products appealing to this trend typically come in a variety set: think of the coffee category, where producers market a box containing six types of roast coffee, with information on where each comes from. Indeed, products in-line with this trend lend themselves well to multipacks or selection boxes which can easily be turned into ‘gift sets’.

“Products containing multiple different varieties of something, be it dark chocolate, sauces, or any other type of food, can be extremely popular during the festive period," Diamond says. "Our latest survey shows 56% of European consumers report that ‘new experiences associated with product purchases’ are ‘essential’ or ‘nice to have’, which is exactly what these types of products can bring people.”

Lifestyle subscriptions and meal kits

The subscription model has seen increased interest in recent years, with brands like Hello Fresh pioneering this commercial opportunity in the food and grocery category. Meal kits more generally have also seen increased uptake. By the end of last year, according to a GlobalData survey, 63% of Europeans reported using meal kits.

Pasta Evangelists, owned by Italian food giant Barilla, is a brand that appeals to people’s desire for authentic products that allow for personalisation and a fun experience. The brand’s website offers recipe kits for delivery, allowing consumers to cook meals at home with bespoke ingredients and instructions. They also offer pasta-making kits, which are also marketed as a gift idea. This type of model encourages brand loyalty and the longer-term usage of the product.

“Though the worst of the inflationary period is over, as Europeans begin their 2024 Christmas shopping, they do so against a backdrop of eroded savings, smaller portions, and lower confidence," Diamond says. "With a quarter of European consumers reporting cutting back on grocery shopping in light of recent price increases, value for money is key. Guilt-free indulgence through sustainable practices and added value in their product purchases through brand authenticity, sensory experiences and food or drink kits that enable people to learn and grow in their tastes and expertise will likely prove very popular.”

GlobalData Consumer Custom Solutions offers sector-level expertise in the CPG, food, beverages, foodservice, retail, apparel, packaging, agribusiness and financial services industries. We use our unique data, expert insights and analytics to answer your bespoke questions with a tailored approach and deliverables. To learn more or have a chat, just drop us an email at consulting@globaldata.com or contact us here, and we'll get in touch!