Orange juice prices have soared in recent months, spiking again in April after a brief reprieve at the start of the year.

This week, the world’s largest producer, Brazil, reported a meagre outlook for 2024 production volumes – stoking fears prices are unlikely to come down any time soon.

The South American country’s main orange-producing areas, Sao Paulo and Minas Gerais, are set to harvest 232 million 40.8kg boxes of oranges this year, down 24 % from the previous cycle, according to research centre Fundecitrus.

This would mark the country’s lowest yield since the 1989 harvest, where Brazil produced 214 million boxes of oranges.

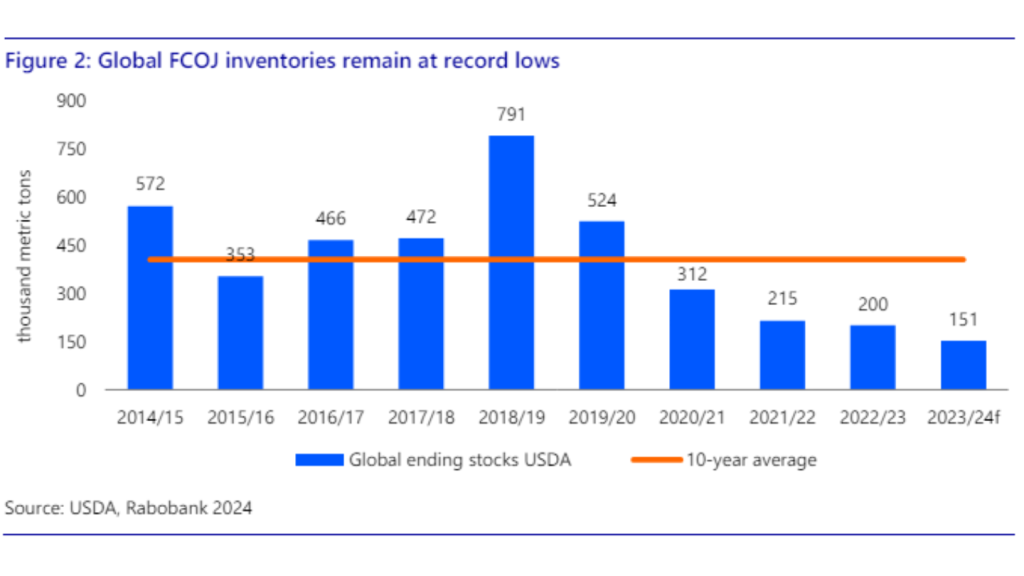

Frozen concentrated orange juice (FCOJ) futures are trading at around $3.50 per pound, according to food and agribusiness bank Rabobank, up substantially from this time last year. Prices reached record highs at the end of 2023, surging over $4 per pound, and have slightly softened in the first half of 2024, but weak supply still lies ahead.

Following a similar trend in other “soft commodities” like coffee and cocoa, severe weather conditions in the main growing countries are causing a production shortage while consumer demand continues to thin, leaving orange juice prices firmly sat at record highs.

Why is production down?

Kees Cools, president of the International Fruit and Vegetable Juice Association (IFU), told Just Drinks the reason for lower production is “mainly twofold”.

Firstly, weather events like hurricanes in Florida – another major orange-growing region – and heavy rain and high temperatures in Brazil have disrupted production.

The combination of above-average temperatures and below-average rainfall in all key producing regions of the Brazilian citrus belt throughout the past 12 months is a major reason for lower productivity.

On average, rainfall from July 2023 to March 2024 was 24% lower than in 2022/23 in the ten largest-producing municipalities, compared to historical average levels, according to Rabobank food and agribusiness research specialist Andrés Padilla.

Secondly, Cools cited a tree disease called greening for the production dip. Greening, also called Huanglongbing, is a bacterial infection of citrus plants. It is one of the most serious citrus diseases in the world. Once infected, most trees die within a few years and there is no cure.

As a result, production figures stand substantially lower currently than in the last decade.

Cools said the main production areas for orange juice are Brazil, the US, Mexico and the EU. In the 2012/2013 season, the total global production in those countries was 507 million boxes (40.8kg), falling to 420 million by 2022/2023.

The IFU president also noted falling numbers of fruit-bearing trees: Brazil went from 209 million in 2011/12 to 169 million in 2023/24. Florida fell from 57 million to 44 million in the same time period.

In terms of yield per tree, Brazil produced 2.12 40.8kg boxes per tree in 2011/12, compared to 1.8 boxes per tree in the 2023/24 season. Florida dropped substantially from 2.3 boxes to 0.4 boxes as a result of the devastating greening disease, Cools said.

He said: “38% of the trees in Brazil are affected with this greening disease, while in Florida the citrus [trees that have been] growing for over 15 years almost has disappeared! No cure for this disease has been found so far.”

According to Reuters, Fundecitrus head Juliano Ayres said at an event that the forecast production numbers “surprised us”.

He added: “Climate effects have strongly affected the industry. For citrus production to remain competitive we must defeat greening – and we will.”

Sarah Baldwin, CEO of UK manufacturer Purity Soft Drinks, said the challenges facing orange juice supplies were wider than unfavourable weather and disease.

“Over the past year, the industry has experienced devastating orange harvests in Brazil and Florida, alongside the ongoing effects of climate change and supply route disruption,” Baldwin said.

“The knock-on effects of conflict in Europe and now the Middle East are also taking their toll on most commodities.

“The escalating costs of cultivating, processing, and supplying orange juice has taken effect on both from concentrate and not from concentrate lines, causing a shortage which has had an inevitable impact on consumer prices.”

How much have prices jumped?

The volume of orange juice exported by Brazil from July 2023 to March 2024 was below that registered in the same period of the previous crop, according to Brazilian research institute Cepea.

It wrote: “According to players from the industry, the low availability of the commodity in the Brazilian market may be limiting shipments. As for prices of the juice sold to the international market, they moved up.”

Looking at Brazilian foreign-trade statistics from Comex Stat, Brazil exported 812.2 thousand tons of orange juice in the same nine-month-period, marking a decrease of 7.7% compared to the same period last season.

Export revenue totaled $2.08bn in the nine months to April 2024, an increase of 23% on the same period in 2022/3. This is edging towards the total figure for the year to June 2023, which stood at $2.14bn.

UK-based soft drinks maker Purity said rising commodity prices have forced it to increase product prices. Baldwin said: “The inflation that we are experiencing is not something that we are able to absorb, so we have been left with no other choice but to increase our costs.

“We’ve tried to avoid passing on these cost increases for as long as possible. To ensure that we remain efficient as a business, while never compromising on the quality of our drinks, this is a route that we have had to take.”

Just Drinks has asked Purity about the exact price increases it expects to implement as a result of orange struggles. It also approached PAI- and PepsiCo-owned Tropicana, which would not comment for this piece.

Will demand continue to weaken?

Orange-juice consumption is expected to continue declining at around 20% year-on-year in volume terms during 2024, which will help to stabilise prices, according to Padilla.

He wrote: “[Declining consumption] should limit the possibility of another significant rise in prices, as long as the harvest hits the expected level of around 260 million boxes with reasonable juice yields.”

The US is set to continue elevated levels of imports in 2024, he wrote, as has been the case since 2022.

However, he said global orange-juice consumption is “clearly being impacted by higher prices and more price readjustments are looming, not least in European supermarkets, which often adjust juice prices in May”.

“Global consumption is on track to close the 2023/24 harvest year with a decrease of around 17% in volume terms and a similar contraction is expected for 2024/25,” he said.

“Volume sales could contract to just 1.1 million metric tonnes during 2024/25, considering additional price increases at retail level, consumer pressures from ongoing high living costs, and changes in consumer habits.

“This would result in a significant decline of over 35% in volume terms, compared to 2018/19 before the pandemic struck. In addition to high prices, the common themes of high sugar content, intense competition from other beverages for share of throat and lack of engagement from young consumers are three factors that continue to contribute to weaker orange juice demand in developed markets,” he wrote.

A lack of certainty behind Brazil’s weather patterns and an incurable greening disease do not bode well for the future commodity prices of orange juice.

Padilla said that a supply-demand balance for orange juice is appearing as a result of recent price rises, not due to any form of supply relief.

However, this equilibrium will also rely on an accurate forecast for Brazil’s orange production for this season, which is by no means a guarantee with a lack of inventories and very high fruit prices.