The 2024 US Presidential elections are due to be held on 5 November this year, where former President Donald Trump and incumbent President Joe Biden are set to go head-to-head.

Trump, who was impeached for the second time in January 2021 but is currently polling marginally ahead of Biden, implemented firm import tariffs when last in power.

In 2018, he imposed US import duty rises on several commodities from China and the EU in particular, on steel and aluminium, among other goods. Brussels retaliated against US import duties by slapping a 25% charge on American whiskey and Bourbon imports.

When Biden came to power, the US and EU agreed to suspend the 25% retaliatory tariff on American whiskeys for two years, starting 1 January 2022. With the end of that agreement nearing, both sides recently agreed to suspend the duties again, this time until the end of March 2025.

However, Trump recently announced his intentions to introduce a universal 10% tariff on all imports into the US, as well as a 60% tariff on Chinese goods, if he were to get back into the White House.

But how is this set to affect the drinks industry?

Which countries will pay the tariffs?

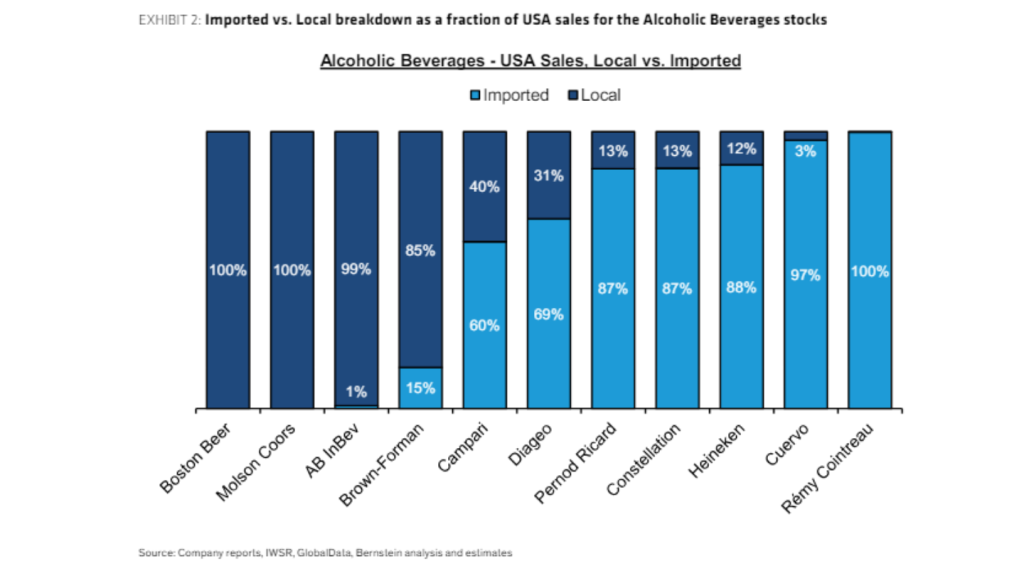

The import tariffs are set to be imposed on beverages produced outside of the US as opposed to locally, which should immediately affect those with a protected designation of origin, such as Tequila, Cognac or Scotch whisky.

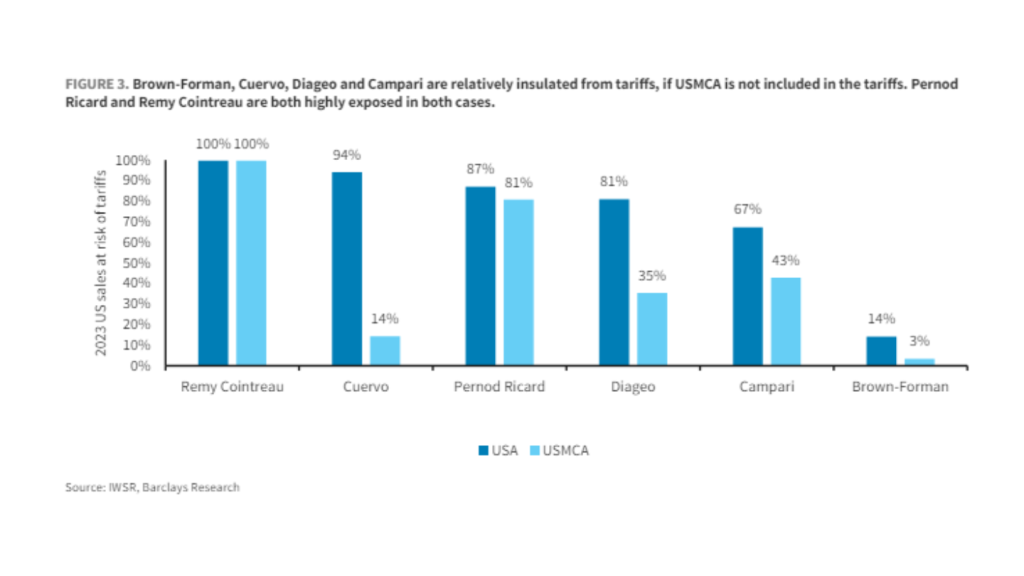

However, according to Laurence Whyatt, head of European beverages research at Barclays Investment Bank, this is initially dependent on whether the tariffs will apply universally to every country outside of the US.

“If he then goes ahead with these tariffs, then of course, that does cause some complications because a lot of what is consumed in the US is not made in the US. And so then it definitely becomes a question of whether those tariffs apply to every country outside the US or every country outside of USMCA.”

The USMCA is a free-trade agreement between the US, Mexico, and Canada which was established in 2020. Whyatt tells Just Drinks whether the tariffs will apply to Mexico and Canada is an “important distinction that we need clarity on”.

He notes: “You can see a lot is made in both Mexico and Canada that is then sold in the US, particularly Tequila and Canadian whiskey.

“Today we haven’t seen anything on that [distinction]. I’ve seen the Canadian government has certainly argued that Canada shouldn’t be included in any tariff. And of course, Trump renegotiated NAFTA [now USMCA] when he was last President. So one might think that Mexico and Canada might be excluded, but at this stage, that’s an assumption.”

Diageo’s number one brand in the US is Crown Royal Canadian whiskey, according to Barclays analysis, and Diageo’s number one category in the US is Tequila.

“So again, with USCMA, as it’s now called, if that’s excluded from tariffs, then Diageo is actually pretty fine,” notes Whyatt. “If Canada and Mexico are tariffed in the same way as everyone else, it is quite impactful to Diageo. And Campari is in a similar boat. Not quite as extreme but in a similar boat.”

Similarly, the distinction is crucial for companies like Jose Cuervo, with almost all its production being Tequila. If Mexico is not tariffed, Cuervo is “absolutely fine and it’s barely impacted”, according to Whyatt.

Who will be hit the hardest?

Tequila, Cognac and Scotch whisky, among other products which cannot be produced in the US, are likely to suffer the most from the 10% tariffs.

Trevor Stirling, analyst at AllianceBernstein, says among the major European drinks companies, the spirits giants are the most exposed to the US in terms of in-market sales.

He adds: “For the Americas coverage, exposures range from close to 100% for Constellation and Boston Beer, to as little as 0% for Ambev. [Jose] Cuervo, Rémy Cointreau and Brown-Forman derive about half of their sales from the country.”

Whyatt similarly agrees that Rémy Cointreau will suffer here as a predominantly Cognac company with the US as its biggest market.

“Almost the entirety of Rémy’s product category would be hit by tariffs no matter what they decided, whether it’s US or USMCA.”

Meanwhile, French spirits major Pernod Ricard will likely be hit hard too as “the vast majority of what they make is European”, according to Whyatt. Two main brands include Absolut Vodka, which is produced in Sweden, and Jameson whiskey, which is distilled in Ireland.

On the other side of the coin, businesses like Brown-Forman, which predominantly makes American whiskey, and big brewers AB InBev and Boston Beer Co., will be “very insulated” from these tariffs as so much of their production is domestic, Whyatt claims.

In wine, non-US producers with a strong presence in the US could be heavily impacted as well.

How will companies react?

Whyatt believes that the companies forced to pay the import tariffs will pass the cost on to their pricing straight away.

“They’ll be very clear with any administration and any government that if you increase tariffs on our products, we are going to pass it on to your citizens. This is not to hit us. And in the same way, if any government were to lower tariffs, they would pass it on to their citizens.

“I think that the companies have been clear on that in the past, that, of course, you can put tariffs on if you want, but it’s your citizens that are going to feel that,” he says.

The tariffs would be applied to the import or transfer price, rather than to the retail price of a product. Whyatt says one can assume “a 10% tariff would lead to a 3-5% price increase on tariffed products”.

This would likely mean a volume reduction of 3-5% as a result, but Whyatt points out that there would varying price elasticity between categories.

“That [volume reduction] could be higher in some categories that have a direct local competitor, like in vodka, so Absolut versus Tito’s, for example. But in a category say like Tequila, which is a very unique flavour profile, you would expect there probably to be lower elasticity than that because if people want Tequila, there’s no alternative. They have to just pay the extra 3% or 5%, whatever it is.

“And you’d expect the lower elasticity in the more unique categories and then higher elasticity on the ones where there’s an easy substitution within the US.”

Stirling claims that the companies would likely absorb the tariffs in the short term as they would “want to know that the tariffs are permanent before passing through”.

He adds: “In the longer term, the ability to pass on these tariffs to the customers will vary, depending on the availability of substitutable products and the strength of the brand equities of the products subject to tariffs.”

Trump’s 10% across-the-board tariff pledge could present some headaches for the European spirits majors if he triumphs in the November election, while domestic beer giants like AB InBev and Boston Beer will barely feel the effects.

However, clarity is needed on the inclusion of Mexico and Canada among these tariffs to understand the full effects, especially on the surging category of Tequila.